It may be a good time to plan that European vacation. The long-weak dollar is gaining strength again, which means you may be able to afford good food, good wine and a quality hotel if you visit the Old World.

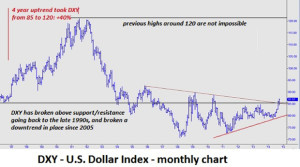

During the Fed Reign of the past five-plus years, the dollar was like that elderly lady in the commercials who says, “I’ve fallen and I can’t get up.” Other countries tried to help by weakening their currencies, of course, but the resulting currency wars appear to have ended along with quantitative easing and now the dollar is strong and getting stronger.

The good news is that the strengthening dollar will make foreign goods cheaper for American consumers (so much for boosting inflation). American companies may also reduce prices or keep them from rising to remain competitive.

As a result, Americans will spend less on essentials like oil and will have more money left to spend on other things, which should boost the economy. A strong dollar will also attract foreign investors to American assets, such as U.S. Treasury bonds.

The bad news is that consumer spending on imports will increase the trade deficit – in fact, it already has. American companies that rely on exports or that have multi-national locations will be hurt.

And if you’ve been investing in foreign stocks because you think U.S. stocks are overpriced (which they, of course, are), you’ll be hammered by the conversion to dollars. When the dollar reverses direction, “currency risk” can dilute investment gains and magnify losses.

Oh, and one more thing. The strengthening dollar could destabilize the global financial system.

Why the Dollar is Strengthening

Before explaining why, consider the reasons the dollar is strengthening:

- Quantitative easing, which was the Fed’s equivalent of printing money, has ended.

- Other countries are continuing to weaken their currencies to boost imports.

- The U.S. economy is strengthening relative to the economies of other countries. It’s not like anyone other than President Obama is going to suggest that the U.S. economy is booming – it’s just that foreign economies are in an even bigger funk than ours.

- Skittishness over other currencies is increasing, which is causing much of the world to use dollars as reserves. It wasn’t long ago that we reported that the dollar’s status as a reserve currency was in trouble. Apparently, not many countries see value in switching to the ruble.

Complain, Complain

Now, you may be thinking, “Brenda, all you do is complain. When the dollar was weak, you complained. Now it’s strengthening and you complain. Aren’t you ever satisfied?”

It’s not that simple. As usual, the Federal Reserve Bank and other central banks play a leading role in explaining what’s happened and what could happen to the global financial system.

As Charles Hugh Smith writes in his OfTwoMinds blog, the risk to the financial system was caused by the unprecedented easy money actions of the world’s central banks.

“In effect,” he wrote, “the central banks doubled down on debt and leverage as the politically expedient ‘solution’ to the implosion of credit and leverage (what we call de-leveraging) as the collateral underlying highly leveraged loans (think subprime mortgages on overpriced McMansions) evaporated like mist in Death Valley.

“Any solution that forced the write-down or write-off of the mountain of bad debt would have collapsed the over-leveraged banks which had become linchpins in the global financial system.”

He’s talking about the whole “too big to fail” conclusion here, of course, which led to the Fed’s buying of trillions of dollars worth of bonds.

“So,” Smith concludes, “the only way to maintain the status quo and avoid handing massive losses of wealth to financial elites was to issue trillions of dollars in new credit-money, lower interest rates to near zero and start buying assets from private-sector owners, turning their assets into cash that could then be used to invest overseas or in domestic stocks and bonds.”

Currency Arbitrage

Such large-scale actions, though, always have unintended consequences. In this case, one of them was the creation of a can’t-lose huge global market for “carry trades,” which is the borrowing and buying of assets in various currencies to take advantage of differences in yield and interest rates.

Taking advantage of the arbitrage opportunity, which has been made easier by technological advances, financial institutions could borrow money in dollars or yen at low interest rates and re-invest it in higher-yielding securities issued in other countries.

So currency markets are where the money is today … just as mortgage-backed securities were the source of huge pre-financial crisis profits in 2007. We now have $11 trillion in cross-national loans, with two thirds of it denominated in dollars, accord to The Telegraph.

For emerging markets, $11 trillion is a lot of money – but there are few options for refinancing that debt, as emerging market countries don’t have central banks like the Fed or the European Central Bank to bail them out.

So what happens to this debt when the dollar strengthens?

“Here’s the risk in carry trades,” Smith writes: “if the currency you borrowed the money in strengthens and the currency you’re receiving the interest payments in weakens, the deal sours. The rise and fall in currencies can erase the profits of the carry trade.”

So you can expect another liquidity crisis.

“And how do you extricate yourself from the carry trade? You sell the emerging-market assets and repatriate the money back into the currency you borrowed the money in: for example, the U.S. dollar,” Smith concludes.

Which will lead to further strengthening of the dollar, and a spiraling liquidity crisis.

Call it 2007 meltdown redux.