A decade after the collapse of Lehman Brothers, many are referring to this month as the 10th anniversary of the Great Recession.

That’s a bit misleading, as the demise of Lehman Brothers was just one symptom of the Great Recession, which began in 2007. During this period, the stock market dropped half of its value, housing foreclosures soared while housing prices plummeted, unemployment levels reached double digits, trillions of dollars’ worth of assets became illiquid and the federal government used billions of dollars to bail out companies such as General Motors and AIG.

A milestone such as a 10-year anniversary creates an opportunity to give pause and ask questions, the most pressing of which should be, “Can it happen again?”

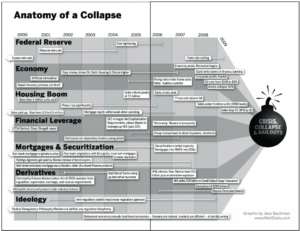

To answer that question, we need to first answer another question: “What caused the crisis?” As Bloomberg opined, “One of the most intriguing aspects of the 2007-09 financial crisis is how little understanding there is of what actually occurred.”

It’s complicated, of course, but clearly when regulations are in place that create incentives for banks to take on tremendous risk, accidents will happen.

One problem leading to the crisis was the Community Reinvestment Act (CRA), which rates financial institutions based on their willingness to ignore their own underwriting standards and lend to people who otherwise would not qualify for a mortgage — because, after all, shouldn’t every American own a home?

CRA regulators encouraged no-doc loans, low or no down payments, and other lending practices the lenders should have known would result in epic-level foreclosures. Bankers lowered their lending standards regardless, as CRA regulators “told banks that lending standards that exceeded that of regulators would be considered evidence of unfair lending,” according to Business Insider.

Home Ownership Dips

As is often the case when the federal government engages in social engineering, the impact of its regulations are the opposite of what was intended. When we discussed CRA last year, home ownership had dropped to a 50-year low.

Fannie Mae and Freddie Mac, quasi-government agencies with a virtual monopoly on the secondary mortgage market, bought many of these high-risk mortgages and bundled them together to create mortgage-backed securities, which they then sold off. Officials in these highly political agencies were compensated based on volume, so they paid little attention to the riskiness of the mortgages, since taxpayers were absorbing the risk.

Rating agencies like Standard and Poor’s were also complicit. Rating agencies were paid by the banks whose mortgages they rated and they typically gave these toxic mortgages AAA ratings.

The Federal Reserve Board also played a role in causing the crisis, according to Investors’ Business Daily, which said the Fed wasn’t the sole cause, “But its mistakes were key. The Fed had cut interest rates to 1% following the 1999-2000 stock market crash, but began raising rates as housing prices and inflation began to rise in mid-2004. In the following years, the Fed relentlessly jacked up rates, from a cycle low of 1% in June of 2004 to a peak of 5.25% in June 2006. In the year preceding that last rate change, there were nine rate hikes total — a rate-hiking frenzy.”

Home prices peaked a month after rates did and the S&P Case-Shiller Home Price Index plunged 27% by February of 2012.

“As home prices plunged, bank losses grew, bank collateral became worthless, and mortgage defaults soared,” Investors’ Business Daily added.

Our next post will look at how the crisis was addressed, then we will explore lessons learned from the financial crisis.