Our past two posts addressed causes of the Great Recession and how it was addressed. Today, we look at lessons learned from the crisis.

It’s easy to forget what happened a decade ago.

The economic recovery is closing in on being the longest in U.S. history, there are more job openings than there are people looking for jobs and personal income is increasing.

But putting the Great Recession behind us makes it more likely that we’ll make the same mistakes all over again. So consider a few lessons from this dismal chapter in American history:

The stock market is resilient. When the stock market lost half of its value, many investors sold off, fearing further losses. Big mistake, as the market began to recover in 2009 and the bull market continues even now.

How would your portfolio look today if you stayed in the market?

“From the market top on Oct. 9, 2007 through the bear market bottom on March 9, 2009,” according to Bloomberg, “the S&P 500 index SPX, +0.33% and the Dow Jones Industrial Average DJIA, +0.36% both lost more than half their value. (The S&P fell 46% just from its close the Friday before Lehman’s fall through its March 2009 low.)

“But those who stuck it out saw the S&P rally 331% from that low through its all-time high on Aug. 29, a compound annual growth rate of 16%-17%.”

A portfolio with 60% in the Vanguard Total Stock Market Index Fund and 40% in the Vanguard Total Bond Market Index Fund would have enjoyed a cumulative return of 129% and a compound annual total return of 8.7%.

Capitalism works. Some will point to the Great Recession and say that capitalism doesn’t work. If it didn’t work, the economy wouldn’t be as vibrant as it is today and your investment portfolio wouldn’t have appreciated as much as it did since the Great Recession.

What doesn’t work is crony capitalism. What doesn’t work is government regulations that attempt social engineering. What doesn’t work is sweetheart deals and special treatment for politically favored companies.

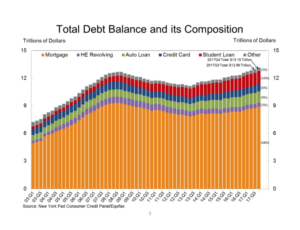

We need to be prepared. As we mentioned in previous posts, many of the circumstances that led to the financial crisis still exist today. Fannie Mae and Freddie Mac, rating agencies, Wall Street banks, the Federal Reserve Board and other players whose clouded judgment and unethical behavior led to the financial crisis are still controlling your financial future.

You can’t control what’s going to happen, but you can prepare for the worst. Keep abreast of what’s happening, keep your portfolio diversified, minimize your debt and hope for the best. Even if there is another crisis, the markets and the economy will recover.