The Fed is expected to raise rates yet again in December, as a hedge against inflation, but some believe a pause is in order.

“With the federal-funds rate at 2% to 2.25%, monetary policy is now close to neutral, neither stimulating nor restricting the economy,” Fed member Neel Kashkari wrote in The Wall Street Journal. “Prematurely tapping the brakes could restrain wage growth and keep many Americans from participating in the economic recovery.”

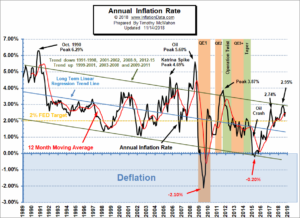

The Fed has achieved its goal of 2% inflation, but we’ve argued that 2% is an arbitrary goal. For no apparent reason, other countries have also adopted a 2% goal. Maybe they figure that if it turns out not to benefit the economy, they can always blame the Fed.

And yet 2% inflation is contrary to the Fed’s mandate. When Congress created the Fed more than a century ago, it made the central bank responsible for prudent banking.

“More or less stable prices and low joblessness were regarded as desirable byproducts of a resilient banking system, not the explicit goal,” Amar Bhide, a Tufts professor, wrote in The Wall Street Journal.

In 1978, when inflation spiked out of control during the Carter Administration, Congress passed the Full Employment Act, which mandated that Congress bring the rate of inflation to zero within a decade.

Arguing for a return to price stability, Bhide wrote that, “There’s no evidence that aiming for 2% does any good, and it could do real economic harm.”

Maybe the Fed sees 2% inflation as normal. We’re not sure why.