In our most recent post, we discussed the Green New Deal. Now we’ll discuss another Congressional proposal that could have a dramatic impact on our economy and markets – Medicare for All.

Most Americans believe that we should all be covered by health insurance. In the world’s wealthiest country, you’d think that treatment for a major illness or injury would be a given.

And so some have supported “single-payer healthcare,” which is inappropriately named, since the “single payer” in this case would be the federal government, funded with trillions in taxes paid by all American taxpayers.

“Single-payer healthcare” is a euphemism for socialized healthcare. Medicare for All, which was introduced by U.S. Senator Bernie Sanders and endorsed by several presidential candidates, is the current attempt at socialized healthcare. The rationale for adopting it is that other countries are doing it, so we should, too. Except that countries that have socialized medicine typically aren’t very happy with it, given that it requires long waits for treatment and is inefficient.

And then there’s the cost. Supporters claim it would lower the cost of healthcare, because profits for health insurers and others would no longer exist, but researchers estimate that Medicare for All would cost more than $30 trillion over 10 years. Several independent studies put the cost at anywhere from $24.7 trillion to $34.7 trillion.

Considering that the federal budget is currently about $3.6 trillion, that’s practically a doubling of the budget.

Medicare Is Broke

As we’ve previously written, Medicare is already broke – and “With 77 million baby boomers retiring, and a $716 billion reduction in future funding of Medicare thanks to the Affordable Care Act (Obamacare), Medicare may be in an even more precarious financial condition than the Social Security system.”

Medicare, which covers 44 million Americans, is funded by a 2.9% tax, split by employers and employees. The Affordable Care Act added a 0.9% tax on incomes above $200,000. Medicare for All would expand coverage to all 328 million Americans, replacing private insurance with government insurance over a four-year period.

Americans would contribute to the cost of prescription drugs, but otherwise would pay nothing – no copays or deductibles. When someone else pays, you can be certain that people will be seeking treatment for healthcare issues that previously went untreated, which is one reason socialized healthcare is expensive and results in long waits for treatment.

Eliminating Private Subsidies

Replacing private insurance would eliminate a current indirect subsidiary that Medicare enjoys. A study by the Congressional Budget Office found that Medicare currently enjoys a generous price break:

“CBO found the average commercial payment rate for hospital admission was $21,400 in 2013, compared to $11,400 for a Medicare FFS (fee for service) patient, which was slightly more than for a Medicare Advantage patient ($10,700). Private insurance rates were 89% higher on average than Medicare FFS rates, according to CBO.”

What will happen to healthcare when Medicare is the only system? Will doctors and hospitals be forced out of business or will they raise the prices they charge Medicare?

Under the proposal, within four years, all Americans would be enrolled in a government-run healthcare plan. According to The Washington Examiner, “They could not enroll in any private plan that offered any of the same benefits as the government plan, effectively doing away with private coverage beyond a possible small market for supplemental insurance.”

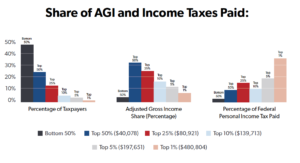

A commonly held belief today is that we can afford programs such as Medicare for All and the Green New Deal by raising taxes on the wealthy. Unfortunately, there aren’t nearly enough wealthy people – and they already pay more than their fair share.

According to the National Taxpayers Union Foundation, “the top 1% of income earners bear the burden of 37% of all income taxes. This is nearly twice as much as their share of income (19.7%). The top 25% of earners shoulder nearly 86% of the income tax load. Combined, the top 50% of earners are responsible for 97% income taxes collected. The other half of filers pay just 3% of all income taxes.”

In other words, much of the tax burden would fall on the middle class.