Part two of a two-part series on SECURE’s new retirement regulations.

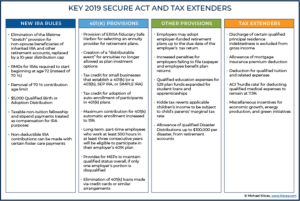

In our last post, we wrote that the SECURE Act (Setting Every Community Up for Retirement Enhancement Act) that was recently signed into law will eliminate stretch IRAs (individual retirement accounts) and make it easier for employers to offer annuities in their retirement plans.

So what else does SECURE include?

Relaxed IRA age restrictions. With many Americans working past age 65, SECURE enables them to continue saving for retirement in IRAs as long as they are earning an income. In addition, those who turn 70½ after Dec. 31, 2019 will not be required to take minimum withdrawals until age 72. Previously, the law required minimum withdrawals starting on April 1 of the year after a person turns 70½.

Incentives for small companies. Currently, about 30% of private-sector employees work for employers that don’t offer a tax-advantaged way to save for retirement.

SECURE makes it easier for small companies to join together in multi-employer plans (MEPs) to offer 401(k) plans, while sharing administrative costs. MEPs are attractive, because they shift some of the administrative burden and fiduciary responsibility to a plan administrator.

MEPs previously were allowed only for businesses with a common owner or some other relationship. Now the businesses are not even required to be in the same industry.

Brokers, asset managers, 401(k) record-keepers and insurers will likely benefit.

In addition, small employers can receive a tax credit to offset the cost of starting up a 401(k) plan or a SIMPLE IRA plan with auto-enrollment. The new tax credit is an addition to the start-up credit that was previously available.

Other changes. The new law also enables employers that automatically enroll employees in certain 401(k) plans to automatically raise their savings rates to 15% of annual earnings over time; before SECURE, the limit was 10%.

It also requires employers to allow certain part-time workers to participate in 401(k) plans.

SECURE allows the tax-free withdrawal of up to $10,000 from 529 education savings accounts for repayment of some student loans. It also enables parents to take a penalty-free distribution of up to $5,000 from a retirement account without penalty within a year of the birth or adoption of a child if the funds are used toward the cost of child birth or adoption.

The law also expands the definition of “income,” which will make more people eligible to contribute to an IRA. Grants and other awards earned by anyone studying for an advanced degree will now be considered income for consideration when making an IRA contribution.

The intent of SECURE is to make it easier for Americans to save for retirement, as the Employee Benefit Research Institute estimates that Americans between the ages of 35 and 64 are $3.83 trillion short of what they need to save for retirement. About 41% of households are projected to run short of money later in life.

The new law may incorporate “the most significant changes to the nation’s retirement system in more than a decade,” as The Wall Street Journal claims, but it’s features are mostly tweaks and are unlikely to cause a major change in how — or how many — Americans save for retirement.