Part Two of a Three-Part Series.

So, if experts believed a capitalist like Donald Trump would have a negative impact on the stock market, what are they saying about the potential impact of a socialist president?

You can’t say they’re not consistent. If capitalism is bad for the economy, socialism must be good for the economy, right? Consider the over-the-top headline on this opinion piece written by Bloomberg’s Nir Kaissar: “Bernie Sanders Could Be the Stock Market’s Best Friend.”

Note that the piece was written by a Bloomberg reporter. You know. Bloomberg. As in former mayor of New York City Michael Bloomberg. The guy who was fighting with Bernie for the Democratic Party’s nomination to run for president when the piece was written. The guy who’s paying Kaissar to write that his top opponent (at the time) would be good for the economy.

I’m guessing that he didn’t get his boss’s approval before running the piece.

How Would This Be Good for Stocks?

Nir Kaissar’s article suggesting that Bernie Sanders would be the stock market’s best friend begins, “Of all the candidates in the 2020 presidential field, including Donald Trump, the U.S. stock market’s biggest booster might just be Bernie Sanders.”

How could that possibly be? The Vermont senator wants not only to reverse the tax reform and deregulation that have driven corporate profits and higher stock prices during the Trump presidency, but to increase taxes. Beyond that, he wants to ban fracking and close down all nuclear power plants, which would send energy prices skyrocketing. (Banning nuclear power would also make electric cars bigger polluters than gas-powered cars, but that’s another story.)

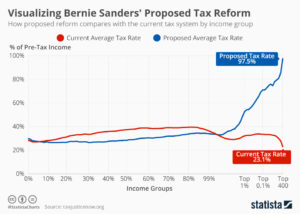

He supports the Green New Deal , which would be so expensive to implement the cost can’t be calculated, and Medicare for All, which has an estimated cost of $32.6 trillion in its first decade. He wants national rent control, which would reduce property values, and forgiveness of all student debt, which would boost the federal debt. Bernie Sanders would also increase both the top income tax rate from its current 37% to as high as 97.5%. The capital gains tax rate would increase from its current high of 20% to 97.5%.

There are many other reasons that a Sanders presidency would wipe out corporate profits and likely cause the stock market to crash. Yet Kaissar, founder of Unison Advisors LLC, believes the staggering deficits that a Sanders presidency would create would boost corporate profits.

“Consider that from 1970 to 2008, roughly around the time that deficits became the norm, the average annual deficit was $129 billion,” Kaissar wrote. “Since 2009, that average has jumped to $882 billion. More than any other single factor, that spike in deficit spending most likely fed the earnings growth behind this bull market.”

So government spending, not lower taxes and less regulation, boosts corporate profits. Can you follow the logic? We can’t.

If that were the case, the Greek stock market (Athens Stock Exchange) would have skyrocketed during the past decade. Alas, stock prices in Greece today are about half of what they were a decade ago.

Greece is still reeling from its sovereign debt crisis and socialism hasn’t helped. Alexis Tsipras, leader of the Coalition of the Radical Left, was elected prime minister in January 2015. He’s now the leader of the opposition party, having been voted out of office after accepting an austerity program similar to one he criticized when he ran for election.