It’s more than twice the size of the stimulus approved during the last crisis. And it’s likely to be just as ineffective.

It’s understandable that the governments of the U.S. and other countries are doing what they can to battle a worldwide pandemic, but the cost of spending trillions of dollars while virtually shutting down the economy is likely to far exceed the benefits.

With the economy virtually shut down, this is not a good time to spend money needlessly. Yet the $2.2 trillion Coronavirus Aid, Relief, and Economic Security Act (CARES) approved by Congress funds everything from extended unemployment benefits to the John F. Kennedy Center for the Performing Arts ($25 million), as well as PBS and NPR ($75 million).

An additional $484 billion spending bill was approved on April 24. That’s on top of an emergency appropriations bill that provided $8.3 billion in spending and the Families First Coronavirus Response Act (FFCRA), which could cost more than $100 billion. An additional $50 billion was made available when the COVID-19 pandemic was declared a national emergency. State and local governments are also spending billions.

But “it’s not enough,” according to Nancy Pelosi, the Democratic Speaker of the House. She and President Trump are already talking about another $2 trillion in spending on legislation to improve America’s infrastructure. They are also working on CARES 2, which is expected to cost more than $1 trillion.

More Spending, Less Revenue

What was approved was a compromise, as Pelosi proposed spending much more, including $300 million for NPR and PBS, and $75 million for the Kennedy Center. She also sought to include mandated “diversity” on corporate and bank boards, a requirement for cash-strapped airlines to disclose and reduce emissions, a mandate for states to allow voting by mail, increased bargaining power for unions, expanded tax credits for wind and solar power, and other special-interest goodies.

Pelosi also sought a $25 billion bailout of the U.S. Post Office, and $1.1 billion to more than double the budgets of The Institute of Museum and Library Services, and the National Endowment of the Arts and the Humanities.

The massive spending has done little to help the small businesses who have been hit hardest by the economic lockdown. CARES included $350 billion in funding for the Paycheck Protection Program, which was meant to provide forgivable loans to encourage small employers to retain employees. Funding ran out in 13 days, with most of the money going to larger businesses that had existing relationships with large banks. Some of the large businesses are now being required to return the money they received.

An additional $310 billion was included as part of a $484 billion appropriation. In return, Pelosi and Senate Minority Leader Chuck Schumer sought additional funding for state and local governments, hospitals and food assistance programs. They received additional funds for hospitals and food assistance. Pelosi and Schumer also sought an exemption allowing Americans who receive food assistance to not have to look for work for two years.

Expect much of what was cut from CARES to return in CARES 2 (or, if you’re a taxpayer, SCARES 2).

They are also increasing the regulatory burden of applying for assistance through the Paycheck Protection Program, which is slowing the pace of government assistance. Every day of delay will mean that more small businesses will fail.

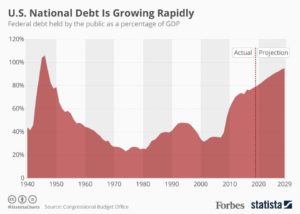

Even before the pandemic, with the federal deficit projected to be more than $1 trillion for the current fiscal year and the total debt approaching $24 trillion, the Government Accountability Office had determined that federal government spending is “unsustainable.”

And now, we’ll be going trillions of dollars further in debt at a time when the government will be collecting far less tax revenue.

More spending and less revenue is a bad combination, unless you believe in the fairy tale of modern monetary theory. So if members of Congress were going to act in the best interest of the American people, they would be certain to focus spending where it will do the most good.

Is this really a good time to be funding the Kennedy Center, which announced that it would be furloughing musicians and librarians on the day its federal handout was approved? Our infrastructure is in need of repair, but can we afford to spend another $2 trillion now? We haven’t noticed too many people driving lately.

Getting a Raise by Not Working

While throwing money at favored groups is normal behavior for Congress, it also made the unprecedented decision to give people who are unemployed a significant raise. You read that right. CARES pays some people MORE to stay at home than if they went back to work!

Congress increased unemployment benefits by $600 a week for four months, more than doubling the $400 average weekly compensation provided.

According to The Wall Street Journal, “A thousand dollars a week is more than what the majority of full-time workers were getting paid before the virus arrived. The $600 bonus is 24 times the $25 bonus Congress paid during the last recession, when government policies that discouraged work severely harmed the economic recovery.”

In addition, anyone who failed a state drug test that is required to receive unemployment insurance will be compensated through an equivalent federal program.

The Journal added that “never before in American history could a majority of the workforce get a raise merely by receiving a pink slip. The aid is also available to people who self-attest they can’t work as a result of coronavirus.”

So those who are staying home now because they have no jobs will continue to stay home. And their former employers, who have been severely impacted by the pandemic, will likely have to pay more money to attract new workers.

As The Journal noted, “the legislative remedies Congress recently passed will make the recovery slower once it’s safe to return to work.”

Some Historical Perspective

Passage of CARES played an important role in helping to calm the panic and stabilize the stock market. But let’s put some history behind this.

During the financial crisis in 2009, Congress approved the American Recovery and Reinvestment Act. At a cost to taxpayers of $836 billion, it was the largest stimulus effort ever. As I’ve previously written, “much of the money went to programs that may have had either no positive economic impact or hampered economic recovery.”

The legislation paid for boondoggles such as the failed high-speed rail service between Borden and Corocoran, Calif., ($4.3 billion) and bankrupt solar company Solyndra. The stimulus was also supposed to rebuild the infrastructure by funding “shovel ready” projects, but few such projects could be found.

It included $64 billion for unemployment compensation and $48 billion for the Supplemental Nutrition Assistance Program (SNAP), increasing reliance on government assistance. And using federal funds to extend unemployment compensation resulted in people staying out of work longer.

Will the outcome be any different this time?

Is stimulus spending even a good idea or is it just an excuse to spend more money? There’s plenty of evidence that economist John Maynard Keynes was wrong about the impact of government spending. Money is used more efficiently in the private sector that the public sector – and it is used to create wealth, rather than add to the federal debt.

Beyond that, however, stimulus spending is supposed to stimulate demand. But the COVID-19 lockdown is constraining supply, so stimulating demand will likely lead to a rise in prices, according to The Wall Street Journal.