Part two of a two-part series.

To revive the economy, we noted last week, the Federal Reserve Board has been purchasing a record number of bonds.

But in addition to buying bonds, the Fed has also taken other steps to increase liquidity and revive the economy. As Schwab noted, the Fed has:

- Introduced a special-purpose vehicle to buy investment-grade corporate bonds to unfreeze the credit markets.

- Opened up swap lines with many other central banks to increase the supply of dollars to the global economy.

- Eased restrictions on banks to free up lending capacity.

“All of these moves are intended to make sure the financial system is functioning and that credit is flowing to households and businesses,” according to Schwab.

In addition, the central bank is lending heavily to businesses, as well as state and local governments.

“By lending widely to businesses, states and cities in its effort to insulate the U.S. economy from the coronavirus pandemic, it is breaking century-old taboos about who gets money from the central bank in a crisis, on what terms, and what risks it will take about getting that money back,” The Wall Street Journal reported.

Among other programs, Congress approved $454 billion for a joint program between the Fed and the U.S. Treasury. Working with the Treasury, the Fed will lend up to 10 times that amount, with the Treasury taking first losses on loans that go bad.

That’s more than $4.5 trillion, making the Fed the world’s largest bank! The Industrial and Commercial Bank of China, considered to be the world’s largest bank, has assets of just over $4 trillion.

The Fed is also expanding a program to finance state and local governments faced with declining tax revenues. The central bank will purchase debt issued by up to 261 municipal borrowers, the 50 states, the District of Columbia, counties of at least 500,000 residents and cities with at least 250,000 residents.

In addition, the Fed “will buy exchange-traded funds that invest in junk bonds, and it will provide financing to investors in business-loan funds known as collateralized loan obligations, or CLOs,” according to The Wall Street Journal.

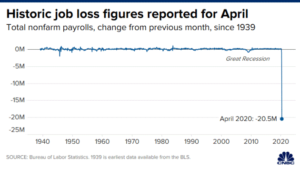

Few people knew what a CLO was before the financial crisis, which you may recall was caused by over-leveraging and creating tranches of high-risk securities. CLOs … Leverage … Bond buying. It’s the Great Recession all over again! Except on a much larger scale.

The Fed is also managing the $600 billion Main Street Lending Program, which will be “its most complicated task, current and former Fed officials say. For the first time since the Great Depression, the Fed will lend directly to small and midsize businesses, offering loans of up to four years through banks,” The Wall Street Journal reported.

Conflict is emerging over the program, as the Fed is placing strict guidelines on loans to ensure repayment. But the smallest businesses that most need the money to survive are also the riskiest businesses, so Main Street may see little benefit from the program.

While it’s commendable for the Fed and Treasury to protect funds collected from taxes, if lending criteria are strict enough to prevent losses, couldn’t the businesses that are receiving loans get the money from their existing lenders?

In total, the Fed is now managing $2.3 trillion in lending programs — to date.

Fed Risks Unmasked

Loan losses are just one of the risks that the new Super Fed faces.

According to The Wall Street Journal, “Among risks the Fed is taking: that some programs won’t work, that officials won’t be able to unwind them, that politicians will grow accustomed to directing the central bank to fix problems its tools aren’t designed to solve, and that public discontent about the central bank’s choices will erode its authority over time.”

Inflation. Then there’s inflation. When you add trillions to the money supply, logic and history would conclude that hyperinflation will result. The logic here is that dropping rates to 0% won’t spur inflation, because it didn’t the last time when the economy was weak, so it won’t this time, when unemployment is expected to reach 25%.

That conclusion may be accurate. But what if it’s not?

Future stock prices. What happens when the Fed stops buying bonds and, instead, seeks to decrease the size of its portfolio? When former Fed Chair Ben Bernanke announced “tapering” of asset purchases by the Fed, the market sank.

During Bernanke’s quantitative easing programs, the market didn’t react to fundamentals, such as profitability, but instead responded to Fed actions. Good economic news became bad news for the stock market, because it signaled an end to bond buying.

As we previously noted, “Rewarding investors for economic underperformance – like punishing them because the economy is performing well – is perverse.”

Politics. “We’re all in this together” is perhaps a hollow theme for the pandemic, as Congress has been as divisive as ever. And while the Fed claims to be apolitical, it’s not.

Will the Fed also use the pandemic for political gain? Former Fed member William Dudley suggested recently that the Fed should help defeat President Trump. He suggested trade policies as a major reason for pursuing that political objective. But would Joe Biden’s trade policies be much different from those of President Trump?

Monetary chaos. Writing on ZeroHedge, Jacob G. Hornberger, founder and president of The Future of Freedom Foundation, said the Fed’s actions will continue the “never ending cycle of monetary crises and chaos.”

Predicting “a bubble of malinvestment and consumer loan defaults that will end up plunging the country in a bubble-bursting recession or even depression,” he wrote that central planning of the economy is socialistic and, “Socialism is an inherently defective economic system.”

Government created our current economic problems by putting the economy in a virtual lockdown. Now we’re expecting government to save the economy. We’re not optimistic.