What may be the most pressing issue when the pandemic ends has not even been addressed by either presidential candidate.

Thanks to the pandemic and the economic lockdown it produced, the federal debt now exceeds $28 trillion. Add in unfunded liabilities, such as Social Security and Medicare, and the total exceeds $135.6 trillion.

While President Trump’s Fiscal Year (FY) 2021 budget calls for $3.2 trillion in net deficit reduction over the next decade, including nearly $2 trillion in cuts to discretionary spending, the Committee for Responsible Federal Spending points out that since his election in 2016, spending has grown nearly $800 billion – from $3.85 trillion in 2016 to $4.65 trillion in 2020.

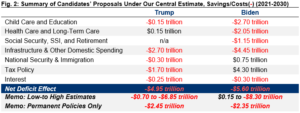

“President Donald Trump has issued a 54 bullet point agenda that calls for lowering taxes, strengthening the military, increasing infrastructure spending, expanding spending on veterans and space travel, lowering drug prices, expanding school and health care choice, ending wars abroad, and reducing spending on immigrants,” according to the Committee for a Responsible Budget. “He also has proposed a ‘Platinum Plan’ for black Americans, which increases spending on education and small businesses.

“Meanwhile, Vice President Joe Biden has proposed a detailed agenda to increase spending on child care and education, health care, retirement, disability benefits, infrastructure, research, and climate change, while lowering the costs of prescription drugs, ending wars abroad, and increasing taxes on high-income households and corporations.”

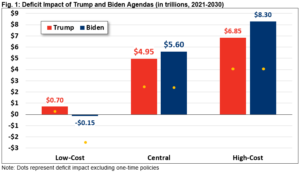

Without including the cost of COVID-19 relief legislation, the committee estimates that the Trump plan would add $4.95 trillion to the debt over the 2021 to 2030 budget window, including $1.7 trillion from lower taxes. The Biden plan would add $5.60 trillion to the debt even after subtracting $4.3 trillion from higher taxes.

Biden has proposed that higher taxes on the wealthiest Americans would help pay for his programs, but the top 1% of American taxpayers already pay 37.3% of all income taxes. That’s more than the total paid by the bottom 90%.

The interest expense on the federal debt cost taxpayers nearly $575 billion in 2019. Today’s near-zero interest rates are keeping the cost of servicing the debt much lower than it would be otherwise, but low rates are giving politicians an excuse to spend even more. What will happen when rates increase?

It’s important to vote on Election Day. But it’s crucial to know not just who, but what you’re voting for.