First of four parts.

We should have been alarmed when the accumulated federal debt reached $1 trillion. Ronald Reagan was president then. Today, our deficit regularly exceeds $1 trillion each year.

We should have been alarmed when federal debt soared past $5 trillion. It now exceeds $27 trillion.

We should have been alarmed when members of Congress spent $4 trillion to fight the pandemic. But we should have been even more alarmed that they wanted to spend another $3 trillion. A spending bill passed the House of Representatives, but Republicans in the Senate wanted to compromise and spend a mere $1.8 trillion. Democrats in the House rejected the offer.

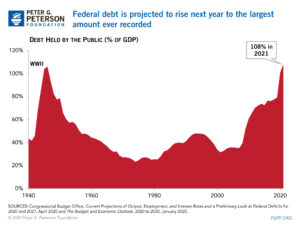

Schwab noted that “the federal debt as a percentage of gross domestic product (GDP) reached 100% in the years following the 2008–2009 financial crisis, and this year’s historic pandemic-relief spending has pushed that number much higher. As of mid-2020, the federal debt stood at 136% of GDP.”

We should have been alarmed when the interest costs for servicing that debt exceeded $100 billion a year. We should have been more alarmed last year, when the interest expense on the federal debt cost taxpayers nearly $575 billion — even with interest rates near zero.

Paying only interest for an extended time can only lead to bankruptcy. It’s like paying the minimum on your credit card. It doesn’t lower the debt. It’s money that could have been used for anti-poverty programs, defense, infrastructure or climate change; practically any other use would be more beneficial. It’s an expense that benefits no one, except our creditors.

And, as Schwab noted, “net interest payments over the next 10 years will crowd out government spending elsewhere.”

But that expense, which we cannot afford now, is only going to grow. Each year’s debt adds to the total debt, which grows bigger and bigger. And the bigger it gets, the faster it accumulates and the more difficult it is to stop.

Worse still, that payment is based on interest rates that are near zero. Eventually, the Federal Reserve Board will need to raise interest rates to keep inflation in check. The Fed will also need to raise interest rates if it wants to lower them the next time we have a crisis.

Interest rates have averaged 5.59% since 1971. With an interest rate of 5.59%, servicing the debt would cost more than $1.5 trillion a year, making interest payments the largest expense in the federal budget.

Put another way, Brian Riedl of the Manhattan Institute estimates that each 1% increase in interest rates will increase the amount of GDP used to pay interest on the debt by 20%.

We should be alarmed now, more than ever. The national debt — what the federal government owes — now amounts to $200,000 from each family in America, according to Riedl.