Second of four parts.

Defense Spending, Tax Reform and Debt

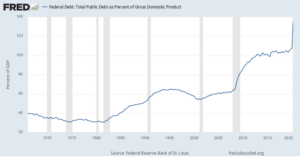

But why are we in so much debt?

Some have blamed defense spending. For example, Doug Bandlow, who served as a special assistant to President Reagan, argued that military spending is a problem and “it’s time to trim the fat.”

“On the contrary, the general trend has been declining defense spending as a share of the economy,” Boston Globe columnist Jeff Jacoby wrote. “Defense spending averaged 5.7% of GDP in the 1970s and 1980s, and was still 4.6% of GDP as late as 2010. It has since fallen to 3.2% of GDP and is projected to continue falling to 2.9 percent in a decade – matching its smallest share of the economy since the 1930s, and not far above the 2% of GDP target for our NATO allies. Since 2017, defense has comprised a record low of 15% of federal spending.”

With North Korea and Iran seeking to become nuclear powers, and China becoming increasingly aggressive, are we spending enough on defense to protect our country?

Others, such as the Center for American Progress, blame tax reform, as lower revenues without lower spending increases the deficit.

But the Tax Cuts and Jobs Act (TRJA) had a relatively small impact on tax revenues, as tax cuts were offset to a large degree by economic growth. If companies and individual taxpayers earn more, they pay more taxes and often at a higher rate.

Tax reform also eliminated some loopholes. And, when rates are lower overall, taxpayers have less of an incentive to look for loopholes.

“Even if the tax cuts are renewed,” Riedl noted, “their $200 billion annual cost cannot explain more than a fraction of the budget deficit’s (projected) expansion from $600 billion to $2 trillion between 2016 and 2030.”