Fourth of four parts.

New Spending?

Given the level of U.S. debt, you’d think politicians would be spending less and seeking ways to at least slow the speed at which it is increasing. Not so much.

As we noted last month, President Biden’s proposals would add $8.3 trillion to the debt by 2030, even after raising taxes by $4.3 trillion and reducing defense spending by $750 billion over that period.

And that estimate may be too low.

President Biden has not endorsed Medicare for All, which has a projected price of $32.6 trillion over its first decade, but he sees his proposal as an extension of the Affordable Care Act.

Among other things, it would bring back the penalty for not having insurance, create a government-run “public option” that would compete with private insurers and drop the Medicare eligibility age from 65 to 60.

The Biden campaign estimated the cost of his proposal at $750 billion over 10 years. Of course, it is likely to cost much more than that while adding millions of people to the insolvent Medicare system.

President Biden has also proposed spending $2 trillion to battle climate change over the next four years. He pledges to end the use of fossil fuels by 2035 and cut net U.S. emissions to zero by 2050.

“While well-intentioned, Biden’s sprawling plan has few concrete cost points and contains many ideas of varying quality,” according to Bjorn Lomborg, President of the Copenhagen Consensus. “He proposes to retrofit millions of homes for hundreds of billions of dollars, although the largest U.S. study of 30,000 retrofitted homes shows that costs are twice as high as benefits.

“Biden also wants to restore the full electric vehicle tax credit, although spending $7,500 for each electric car is one of the costliest ways to cut emissions.”

While more progressive candidates have advocated the forgiveness of all student debt, President Biden would only cover tuition for those who attend two years of community college or high-quality training programs.

In addition, Biden’s plan would forgive student debt for those who have been paying it back for 20 years or more. Also, those working as teachers, in non-profit organizations or in some other “national or community service” would receive $10,000 in debt relief each year for up to five years. The estimated cost of his plan is $750 billion.

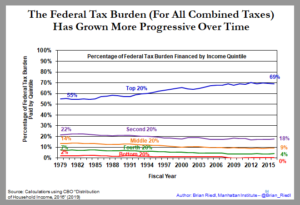

There are plenty of other costly proposals and the standard way of paying for them is to increase taxes on the wealthy. As we’ve previously noted, the top 1% of American taxpayers already pay 37.3% of all income taxes. The top 20% of earners pay 69% of all federal taxes.

Even if all of the income produced by wealthy Americans were taken in taxes, it wouldn’t come close to paying for proposed new programs, funding existing programs and servicing the debt.

Remember that debt today amounts to $200,000 per family. Yet politicians keep spending. It’s time to be alarmed.