Part two of a two-part series.

If economic growth is the goal of the American Rescue Plan (ARP), handing out checks and raising the minimum wage won’t help the cause much.

Americans have already received checks for $1,200 and $600. The ARP would provide another Economic Impact Payment of $1,400 to most Americans.

Who doesn’t like to receive a check from the government? But sending people checks that will be paid back with much higher taxes has not been found to be very economically stimulating.

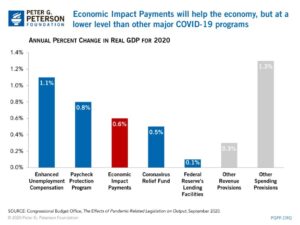

“The Economic Impact Payments helped alleviate the financial hardship faced by many Americans due to the COVID-19 pandemic and provided a modest boost to the economy,” according to the Peter G. Peterson Foundation. “However, many of the payments went to higher-income households not financially affected by the pandemic who simply saved the money or used it to pay off existing debt.”

The $600 stimulus check sent out in December included income limits, so it was at least targeted to help Americans who needed the money most. The next check may at least help those who need it, but don’t expect it to do much for the economy.

Hurting Small Businesses

Higher unemployment benefits and a $15 minimum wage may also help struggling Americans, but will also be harmful to small businesses that have been trying so hard to hang on throughout the pandemic. Restaurants, which are among the businesses hurt most by the pandemic, would be among the businesses damaged further by enhanced unemployment benefits and a higher minimum wage.

Paying more to people who are jobless may be good politics, but it gives them less incentive to look for new jobs and it makes it more difficult for employers, who are also strapped for cash because of the pandemic, to bring back laid off employees.

The unemployment rate dropped significantly last summer when the federal government stopped paying an additional $600 a week for laid off employees to remain jobless.

In addition, studies have shown that raising the minimum wage destroys jobs. That will especially be true now, given that so many small businesses are still recovering from lockdowns and, in some cases, destruction of property during last year’s rioting.

President Biden’s proposal would more than double the minimum wage from $7.25 an hour to $15, but for tipped workers, it would increase their minimum by more than 600%.

Currently, tipped workers have a minimum wage of $2.13 an hour, but with tips added in they are required to be paid at least the $7.25 minimum. ARP would require that they receive the $15 minimum, not including tips.

Restaurants laid off about six million workers during the first two months of the pandemic and, after limited re-openings, they ended 2020 with 2.5 million fewer jobs than before the pandemic, according to The Wall Street Journal.

A recent study from economists at Miami and Trinity universities found that a $15 minimum wage would result in the loss of more than a million jobs in the hospitality industry.

In Seattle, which adopted a $15 minimum wage, a research team linked to the University of Washington found a 13% increase in the rate of businesses leaving the city or closing as a result of the increased minimum wage. And that was before businesses were hurt by the pandemic.

President Biden said it is essential to use the government’s borrowing power to help struggling families, but businesses are struggling, too. Including both of these business-killing giveaways in an economic recovery bill is not going to help the economy any more than paying farmers not to grow crops.