Part two of a three-part series.

Investors frequently are attracted to the stock of newly public companies.

The big money, though, is often made by those who invest before and during the initial public offering (IPO). And individual investors have little chance of participating.

Typically, 90% of IPO stock is allocated to institutional investors, such as pension funds, while the remaining 10% goes to individual investors. Even then, the average investor will not qualify to purchase the stock until it is widely available on a stock exchange, such as Nasdaq.

“Before you can participate in an IPO,” according to Fidelity, “you must first meet your brokerage firm’s eligibility requirements. In addition, you must meet Financial Industry Regulatory Authority (FINRA) requirements, which generally can be accomplished by answering a series of questions asked by your brokerage firm.”

Individual investors may need to be part of a brokerage’s “private” client group or have significant household assets. For Fidelity, that may mean assets with a value of at least $100,000 or $500,000, depending on the IPO, excluding any annuities and assets in your retirement plan.

Even if you meet these requirements and go through the process of requesting an allocation of IPO stock, your chances of receiving an allocation are often slim — especially if it’s a hot stock, such as Airbnb or DoorDash.

“Typically, customers with significant, long-term relationships with their brokerage firm will receive higher priority than those with smaller or new relationships,” according to Fidelity.

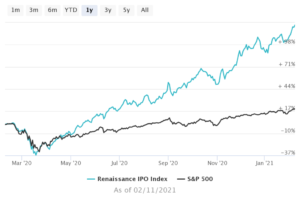

Once an IPO takes place and the newly public company’s stock is trading on the Nasdaq (or another exchange), any investor can purchase the stock. Getting in early on an IPO can be lucrative — but stock buyer beware. It’s always best to be careful, but that’s especially true with small companies whose stocks are brand new and vulnerable.

A newly public company’s stock price is typically far more volatile than that of a mature blue-chip company, such as companies in the Dow Jones Industrial Average or the S&P 500. Because of its volatility, it may also be the target of short sellers, who bet on the stock price going down.