Part one of a two-part series.

Many Americans, especially progressives, believe that the income gap between the haves and the have nots is too large.

Progressives see income inequality as a flaw in capitalism and a reason to transform the economy to socialism. In the name of “equity,” the Biden Administration and Democrats in Congress are seeking to increase taxes on those who are wealthy and add to government entitlements for those who are not. They are advocating for a guaranteed income for all Americans, a $15 minimum wage, forgiveness of student loans and other programs to reduce the income gap.

But is income inequality in the U.S. as problematic as progressives say it is? And will the changes proposed solve the problem, make matters worse or cause other problems?

How Unequal Are We?

Oft-cited data from the U.S. Census Bureau shows that income inequality in the U.S. increased 21.4% from 1967 to 2017, but the data doesn’t take into account the higher taxes paid by those with wealth or the government transfer payments provided to low-income Americans.

“While the disparity in earned income has become more pronounced in the past 50 years, the actual inflation-adjusted income received by the bottom quintile, counting the value of all transfer payments received net of taxes paid, has risen by 300%,” Phil Gramm and John F. Early wrote in The Wall Street Journal. “The top quintile has seen its after-tax income rise by only 213%. As government transfer payments to low-income households exploded, their labor-force participation collapsed and the percentage of income in the bottom quintile coming from government payments rose above 90%.”

Gramm and Early found that, once taxes and transfer payments are included, income inequality has actually decreased over the past 50 years.

Poor Americans, of course, need help. But they currently benefit from about 100 federal programs, including Medicaid, Medicare, the Supplemental Nutrition Assistance Program (SNAP), Aid to Families with Dependent Children (AFDC), and many other programs, which make up more than 40% of federal spending. They also benefit from state and local programs.

It would be nice to do even more, but the current system is financially unsustainable and ineffective. As we’ve noted, the War on Poverty that began in the 1960s has cost trillions of dollars and has done little to decrease poverty in the U.S.

Still, that’s not stopping President Biden and the U.S. Congress from adding trillions to the federal debt, which exceeds $28 trillion.

The American Rescue Plan, marketed as COVID relief, cost $1.9 trillion, on top of the $6 trillion or so already spent by the government on the pandemic. His proposed infrastructure bill, which he’s called the American Jobs Plan, would add another $2.3 trillion. Isn’t paying for these and other proposals going to make us all poor?

The ultimate goal, if America’s poor are to lead lives with dignity, free of government assistance, should be to create jobs for everyone. Otherwise, poverty will continue from one generation to another, while the cost of government programs will continue to rise and the country will become bankrupt.

But the programs being proposed will cost trillions and new taxes will be needed to pay for them. President Biden may claim that the American Jobs Act will create 19 million job, but he’s proposing a 7% increase in the corporate tax rate to pay for it. Taxes paid by corporations reduce the amount available to invest in business growth, so higher taxes result in fewer jobs.

Conversely, before the pandemic, tax cuts helped bring unemployment to its lowest level in 50 years. As a result, the poverty rate in America has declined annually — down from 11.8% in 2018 to 10.5% in 2019, according to the Census Bureau.

The Wall Street Journal noted that in the first two years after passage of the 2017 Tax Cuts and Jobs Act, “real median household income increased by $4,900. Employment surged, especially among the long-term unemployed, the poor and minorities. Wealth for the bottom 50% of households advanced three times as fast as for the top 1%.”

Who Pays Taxes?

Even without increasing taxes, the United States already has arguably the most progressive tax system in the world, with more than 80% of all taxes paid by the top 40% or earners, and more than 70% of government transfer payments going to the bottom 40%.

Before tax reform, the Organization for Economic Cooperation and Development (OECD) found that, based on income taxes and Social Security contributions, the U.S. “has the most progressive tax system (in the world) and collects the largest share of taxes from the richest 10% of the population.”

Did tax reform change that? Not much.

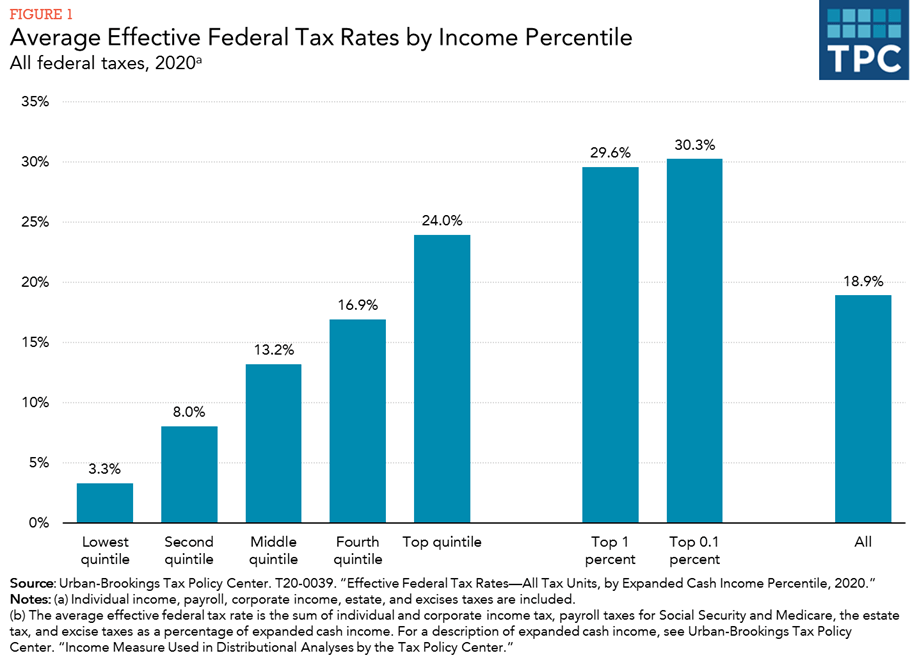

The Tax Policy Center found that in 2020, the top 20% of earners in America contributed 24% of their income toward federal taxes. The bottom 20% contributed 3.3%, while the average American contributed 18.9%. Even with deductions and loopholes, the top 0.1% of earners contributed 30.3% of their income to pay federal taxes.