Part one of a two-part series.

The term “millionaire” has lost much of its luster. In the 1950s and 1960s, being a millionaire implied a level of wealth and exclusivity that few could hope to achieve.

Because of economic growth and inflation, becoming a millionaire has gradually become more achievable. By the time The Millionaire Next Door was published — 25 years ago — achieving a net worth of a million dollars was a realistic aspiration for many Americans.

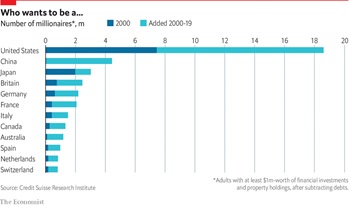

Today, according to The Global Wealth Report, the United States is home to 18.6 million millionaires, which is 3% of the population and 7.6% of the adult population. The U.S. represents just 4.25% of the world’s population, but it’s home to about 40% of all millionaires worldwide.

Billionaires are increasingly common, too. As of 2020, the U.S. had 705 of them. Socialist Senator Bernie Sanders says there should be no billionaires, but he’s just a millionaire.

The good news is that American innovation and our capitalist economy have made the United States the wealthiest country in history. The bad news is that, thanks to inflation, $1 million is a modest amount of wealth. Depending on your lifestyle, it may not be enough to support your retirement.

Becoming a Millionaire

Regardless, achieving millionaire status is a worthy financial goal for the 97% of Americans who aren’t there yet. So how do you get there?

Only about 20% of millionaires are lucky enough to inherit wealth. Investment bankers, CEOs, doctors and lawyers earn enough money to become millionaires. Others, such as athletes and celebrities, have special talents that enable them to earn large incomes. Most of us lack those abilities.

Others become wealthy by investing wisely. A very small number get rich by being lucky. They may win the lottery or hit the jackpot at a casino. Or their wealth may come from a legal settlement, which is often the result of bad luck, rather than good luck.

Thomas C. Corley, who spent five years studying how people become wealthy, found that wealthy people generally fall into four categories: the Saver-Investor, the Big Company Senior Executive, the Virtuoso, and the Dreamer-Entrepreneur.

Big Company Senior Executives and Virtuosos make up the minority of millionaires. Most millionaires are Saver-Investors, Dreamer-Entrepreneurs or both. Saver-Investors are ordinary people who typically save 20% or more of their income and invest their savings prudently over a period averaging 32 years.

A small majority of those interviewed by Corley (51%) are Dreamer-Entrepreneurs. Owning a small business requires a big commitment, as well as significant risk. Of those interviewed, 27% had a business they started fail.

If you want your business to generate enough income to make you wealthy, expect to work long hours. You will also need to be good at making decisions and managing money. But if your small business generates enough income, it can eventually make you wealthy.

Of course, it’s not just what you earn that’s important, it’s what you do with it. If you invest it, your odds of becoming wealthy will be much higher than if you spend it. That may sound like common sense, but many people try to live like they’re wealthy before they are; they wrack up debt and end up broke.

The most important lesson from The Millionaire Next Door is that if you want to become a millionaire, you’ll need to live frugally. You don’t become a millionaire by maxing out your credit cards every month. Keep debt to a minimum and don’t buy anything you can’t afford. Look for sales, cut coupons and don’t be wasteful.

The more money you save by living frugally, the more money you will have available to invest. The wealthiest 1% of Americans put three-quarters of their savings into investment assets, according to CNBC, while those in the middle class have most of their assets tied up in their homes.

In one of his most well-known quotes, Warren Buffet noted the importance of making investment a second source of income. Whether you invest in stocks, real estate, cryptocurrency or some other asset, you will also need patience, as it will likely take decades of saving and investing to become a millionaire.

Whether you get there or not, aspiring to millionaire status gives you a goal. And if you consistently put effort into it, you’ll increase your probability of achieving it.