Part two of a two-part series.

Once you are reasonably wealthy, you may find that adding to your wealth is less of a struggle. The rich often do become richer.

Is this an unfair consequence of a capitalist society? Not exactly. Consider why the rich get richer.

Sound financial and work habits. If, as in most cases, a person became wealthy by living frugally, that habit will likely continue once wealth is achieved. What made you rich can make you richer.

We can all live frugally, invest or start a business. Some of us will inherently be better at it than others. Some of us will be lucky. Some of us will work harder at it than others. But we all have opportunities.

Compounding. One reason it can take decades to become wealthy is that the wealth-building power of compounding can take a lot of time before it works. Compounding can make anyone’s investments multiply in size, but it takes time. However, time is less of a factor if you already have wealth.

Let’s say a person of wealth has $10 million to invest and you have $100,000. If the person with $10 million earns a 10% return this year, he will have a $1 million return. Assuming your $100,000 is also earning 10%, your return after a year will be $10,000. It would take 7.2 years for your portfolio just to double in value. But your $200,000 would double in value again in 7.2 years to $400,000, then to $800,000 after another 7.2 years.

Hold onto your investments for a couple of years after that and you’ll likely achieve millionaire status — after about 24 years.

A 10% return for a wealthy investor may be worth millions. For the average investor, it is more likely worth thousands. What an average investor makes in a year, a wealthy investor makes in a day. If it’s a bad day.

Ability to take risks. Wealthy investors can also afford to take more risk than the rest of us. Higher risk often yields greater rewards — and those who are wealthy can afford to take risks that the average investor cannot afford to take. They likely have their money in enough different investments that if one fails, another provides significant rewards.

Attracting the best advisors. Even so, their risk is likely less than it would be if the wealthy didn’t attract the best financial advisors. Everyone wants to manage their money, so they have family offices and teams of professionals to do their bidding and ensure that they earn high returns without taking unnecessary risk. They get the best-of-the-best advisors (at a discounted rate). You get the robo-advisors.

Those who are rich can afford the best lawyers and accountants, too. But the large sums they pay for their services are helping to make others rich, too.

More choices. Wealthy people can also invest in assets that others cannot. Hedge funds, for example, have minimum investment requirements, ranging from $100,000 to $2 million.

In addition, some investments, including private equity, hedge funds and other private deals, are open only to accredited investors, because regulators assume that the average investor lacks the knowledge and expertise to invest in such potentially lucrative investments. Accredited investors must meet certain criteria, such as having a net worth of $1 million or more, or earning income of at least $200,000 a year.

The Obama Administration touted its opening of private equity to average investors when it enabled them to dabble in crowdfunding. Crowdfunding may be the riskiest investment ever, and the changes of earning a significant return on investment are tiny. Companies that rely on private equity may be worth billions and typically have a great deal of potential, but the average amount raised in a crowdfunding campaign last year was just $824.

Those with wealth are also the first people to be “allocated” shares in potentially hot IPOs. They’ll take precedent over average investors because of their “brokerage relationship,” meaning they make money for the brokerage, while the little guy does little to help the bottom line.

Today’s automated investing has also created opportunities that primarily benefit institutional and wealthy investors, such as high-frequency trading, quantitative funds and dark pools.

Increased influence. If you achieve a high level of wealth, you will likely develop a new group of acquaintances. You may be invited to join boards. You may choose to make big donations to non-profits or politicians. You may even decide to become a politician yourself, like Michael Bloomberg and Donald Trump, to name just two.

If you have enough wealth, you may be in a position to influence policy or to at least have your views be heard by influential people.

If you’re feeling envious about those who are rich, you may take some consolation in knowing that wealth can be fleeting. The average millionaire goes bankrupt 3.5 times. And 70% of wealthy families lose their wealth by the second generation.

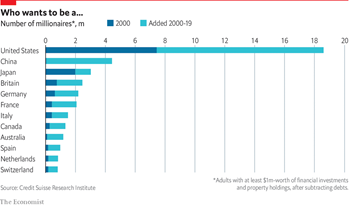

You may also take some inspiration in knowing that, based on current projections, 1,700 Americans become millionaires every day. If you want to join them, you know what to do.