Part one of a two-part series.

Federal entitlement programs, which are created to address social issues, often make matters worse. They also cost more than initially projected and they are practically impossible to eliminate.

Yet the Biden Administration is seeking to expand entitlements into the middle class.

“Entitlement” is the right word. An entitlement is a right to receive something. Once created, entitlements “are nearly impossible to repeal, or even reform,” according to The Wall Street Journal. Entitlement spending is mandatory. To reduce funding, Congress has to change the law that authorizes the entitlement.

Entitlement spending was practically nonexistent at the beginning of the 20th century. During the Great Depression, with the New Deal, entitlement spending accounted for 1.5% of gross domestic product (GDP).

Social Security boosted entitlement spending to 5% of GDP by 1960. The passage of Medicare, Medicaid and Great Society programs pushed entitlement spending’s share of GDP to 11% by 1971. Additional programs and rising costs drove entitlement spending to 17.1% of GDP by 2015 and pandemic-related spending pushed costs to 22.3% of GDP in 2020.

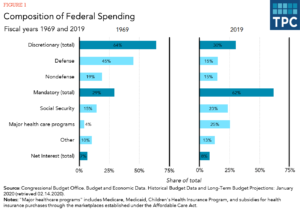

Entitlements now account for most federal spending. As of 2019, 62% of the federal budget was used to pay for entitlements, including Social Security, Medicare, Medicaid and other social programs, as well as government employee pensions. Medicaid costs would push the percentage even higher, but states contribute, on average, 35.6% of the costs.

Middle Class Entitlements

Even with the pandemic easing, America reopened and the economy growing, entitlement spending is not about to ease up. In fact, the Biden Administration is proposing what The Wall Street Journal calls “the biggest expansion of the entitlement state since the 1960s.”

Under the cozy title of the American Families Plan, the federal government would pay for “child care, government paid family leave, free community college, a $3,600 tax credit per child, a permanent expansion of ObamaCare premium subsidies, universal pre-K, permanent expansion of the earned-income tax credit to workers without children, and more,” The Journal reported.

An additional 21 million Americans will receive government payouts if the plan is approved as written and many of the recipients would be far from needy. The plan calls for $1.8 trillion in investments and tax credits for American families over 10 years.

“Two-parent households with two preschool-age children and incomes up to $130,000 would qualify for federal cash assistance for daycare,” The Wall Street Journal reported. “Single parents with two preschoolers and incomes up to $113,000 would qualify. And some families with incomes over $200,000 would be eligible for health-insurance subsidies. Other parts of the plan, such as paid leave and free community college, have no income limits at all.”

If you’re a member of the middle class, you may be thinking that all of these benefits sound great, especially since, you’ve been told, they will be paid for by “the rich.” The American Families Plan and other spending proposals call for increases in the capital gains tax, estate taxes and other taxes that primarily affect those who are wealthy.

Unfortunately, there aren’t enough rich people to cover the costs. And, if you’re rich, you’re likely to hire accountants whose job it is to minimize your taxes. That’s one reason such taxes raise less revenue than predicted.

And if equity and fairness are important, consider that the top 20% of earners in America contribute 24% of their income toward federal taxes, while the bottom 20% contribute 3.3%, according to the Tax Policy Center. Even with deductions and loopholes, the top 0.1% of earners contribute 30.3% of their income to pay federal taxes.

As spending balloons and projected revenues fall short, taxes on the rich may make up some of the shortfall. Congress is unlikely to put the burden of middle-class entitlements on lower-income Americans, so taxes on the middle class will have to increase. And as more money is used to pay taxes, less money will be available for investment, resulting in less economic growth, less wealth and fewer jobs.

In other words, you’ll be paying the federal government to pay you. And you’ll have plenty of forms to fill out before you get your money.