Part two of a two-part series.

For three years during the Trump Administration, the Fed modestly raised interest rates, but it changed direction when the pandemic and the accompanying lockdown hit, resuming its zero interest rate policy (ZIRP).

If you live in a fantasy world, reducing interest rates will make housing more affordable. But in the real world lower rates increase demand, which increases prices.

Demand is also being driven by the 72.1 million millennials that have reached home-buying age. Having recently supplanted Baby Boomers as the largest population group, millennials are starting families and causing demand to surge.

Demand has also been pushed by the pandemic. Locked-down city dwellers sought more breathing space by moving to the suburbs or to states like Florida, which was libertarian with its lockdown compared with authoritarian New York and California. Many are still working from home and want to live in the suburbs, rather than in congested cities where their families would more likely be affected in case of a COVID resurgence.

Demand is being stimulated at a time when there is little supply. During and after the financial crisis, home builders stopped building. Those who tried in many cases met resistance from local boards. Many towns and cities have restrictive zoning laws to keep traffic in check, to avoid strain on their school systems and for other reasons.

Housing inventory decreased during the Great Recession of 2007 to 2009 and remained low even as the pandemic hit and held housing inventory down even further. Shortages of affordable labor and materials also affected housing prices. The price of lumber, for example, skyrocketed during the pandemic. Currently, inventories are down more than 38% year-over-year and are at historic lows, according to The Balance.

“A recent bank note from Jefferies said the U.S. was short 2.5 million homes,” BusinessInsider reported, “while Freddie Mac put that estimate higher at a shortage of 3.8 million. There are 40% fewer homes on the market than last year, a Black Knight report found.”

Inflation Across the Board

Meanwhile, inflation in general has been picking up. When Americans have to pay more for food, clothing, energy and other purchases, it becomes more difficult to save money for housing.

Those who are renting while they save for housing are also being squeezed, as rents have increased. Today, more than half of renting households are “rent burdened,” meaning more than 30% of their income is needed to pay their rent. Worse still, 26% of households spend more than half of their income on rent.

While the Fed says inflation is “transitory” and blames it on supply chain issues, it is continuing ZIRP even as the economy has grown beyond its pre-pandemic level. And while the Fed continues to purchase $120 billion in bonds each month, the Biden Administration continues to spend as though the pandemic has just begun.

“With the recession over and our strong economic recovery well underway, I am increasingly alarmed that the Fed continues to inject record amounts of stimulus into our economy by continuing an emergency level of quantitative easing (QE) with asset purchases of $120 billion per month of Treasury securities and mortgage-backed securities,” Democratic Senator Joe Manchin wrote to Fed Chair Jerome Powell. “The record amount of stimulus in the economy has led to the most inflation momentum in 30 years, and our economy has not even fully reopened yet.”

And while Senator Manchin notes that record stimulus and bond buying are boosting inflation, The Wall Street Journal reported that he is supporting the Biden Administration’s $1.2 trillion infrastructure bill, as well as up to $3.5 trillion in new spending for Senator Bernie Sanders’ budget resolution.

The new spending comes on top of the $4.6 trillion allocated to COVID-19 relief programs, of which $3.6 trillion has been spent or is committed to be spent.

So here we are as the pandemic continues to lift with the government seeking to spend another $4.7 trillion, even as it hasn’t fully spent $4.6 trillion previously allocated for COVID-related spending.

“Monetary policy is stimulating the economy more aggressively than at any time since the Great Depression,” economist Stephen Miran wrote in The Wall Street Journal. “Households also have more than $2.5 trillion in excess savings they are beginning to spend, unemployment benefits have pushed up the wage demands of new hires, and the economy is still turbocharged from the wildly excessive American Rescue Plan Act, passed this spring.”

Inflation is also driven by the cost of doing business, which goes up when Congress passes new regulations. The proposed infrastructure legislation includes many new regulations, including, Miran wrote, “a mandate for new cars to have breathalyzer and eye-tracking technology to prevent drunk driving, climate technology for preventing children from being accidentally left in vehicles on hot days, safety technology for automatic emergency-braking and crash-avoidance systems, lane-departure warnings and corrections, specialized rear guards on certain types of vehicles, automatic shut-off systems, and more.”

The Biden Administration is also expected to reverse much of the deregulation that took place during the past four years, including financial and environmental deregulation.

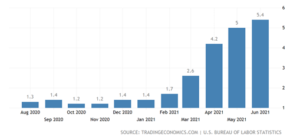

The Fed’s inflation rate, which excludes food and energy, was 6.1% for the second quarter. But it’s likely to go even higher, as a survey by the Institute for Supply Management found that 66.7% of service businesses are raising prices and fewer than 1% are cutting prices.

Higher inflation will continue to boost the price of home ownership, but housing isn’t the only thing that many Americans will be unable to afford.