Part one of a two-part series.

Interest rates have been near zero for the past 15 years, except for a brief period when they rose as high as 2½%. That’s still less than half of the average rate for the past 50 years, which is 5½%.

But imagine if the federal funds interest rate were to increase to 20%, as it did in 1980.

Increasing interest rates to that level would have a devastating impact on business, real estate, the stock market and the entire economy. But consider what would happen to the federal debt.

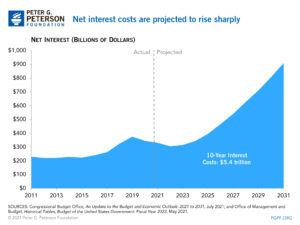

With the federal funds rate at a range of 0% to 0.25% today, servicing the debt cost taxpayers $378 billion for the just ended fiscal year ($405 billion, according to the U.S. Debt Clock). At 20% interest, servicing the debt would cost more than $30 trillion a year. That’s nearly $250,000 a year for every household in America!

And that’s based on the current level of debt. When Paul Volcker, then chair of the Federal Reserve Board, engineered the rate increase to tame inflation, federal debt had risen to $908 billion from just $371 billion in 1970. Currently, the federal debt is just under $29 trillion and it’s increasing at a faster pace than ever.

Inflation May Not Be “Transitory”

Fortunately, the rate of inflation is lower today than it was in 1980, when it soared to 13.5% (after 11.35% inflation in 1979). But it’s rising rapidly and may not be as “transitory” as Federal Reserve Chair Jerome Powell would have us believe.

The annual inflation rate reached a 13-year high of 5.4% in June and July, followed by a slight decrease to 5.3% in August. However, wholesale prices for producers rose 7.8% in July and 8.3% in August. Both are records dating back to at least 2010, when the statistic was first tracked.

Like high interest rates, high inflation would be an economic wrecking ball, reducing the purchasing power of both consumers and businesses. It would cause economic growth to slow down and unemployment to increase. Low-income Americans would be hurt most. Even with demand for workers pushing up wages, increases are not keeping up with inflation, according to The Wall Street Journal.

Lowering inflation was not easy in 1980. Given that it would be impractical to raise rates to anywhere near 20% today, what will the Fed and Congress do to tame inflation if it continues to increase?

“There is no way of slowing down inflation that will not involve a transitory increase in unemployment, and a transitory reduction in the rate of growth of output,” according to economist Milton Friedman. “But these costs will be far less than the costs that will be incurred by permitting the disease of inflation to rage unchecked.”

What Inflation?

While inflation is still far below where it was in 1980, it is also “the single most important indicator for investors at the moment,” according to The Wall Street Journal’s James Mackintosh.

If inflation is perceived as being out of control, perception will lead to reality and inflation will continue to increase. That may be why Chairman Powell spent most of his virtual address last month building his case that higher inflation is temporary.

“The spike in inflation is so far largely the product of a relatively narrow group of goods and services that have been directly affected by the pandemic and the reopening of the economy,” according to Powell.

He added that prices appear higher now, because they declined at the beginning of the pandemic. The 12-month period used to measure inflation captures the rebound in prices, but not the initial decline, making inflation appear to be higher.

In addition, prices of goods that have been most affected by inflation, such as used cars, are beginning to drop as supply chains reopen. And if inflation were a persistent problem, he argued, wages would be rising faster than inflation, creating a “wage-price spiral.”

He expects technology, globalization and other factors to keep inflation in check long-term. But for someone who’s not worried about inflation, he spends a lot of time talking about it.

“The Fed’s position does not match the reality that Americans are experiencing in the economy,” according to YourSource News. “As consumers are being confronted with increasing prices across a wide spectrum of goods, Chairman Powell is still suggesting that inflation is nothing to worry about at this point in our recovery.”