Recently, there has been a lot of news about rising interest rates ending the bond rally.

Investors who have a significant percentage of their investments in bonds may be getting nervous, but there’s a simple strategy for protecting principal and taking advantage of increasing interest rates.

Bonds generally make up a significant portion of a diversified portfolio, so if the bond rally is over, it is important to be positioned in bonds that will maintain their value in a rising interest rate environment.

If you own individual bonds or a bond fund, it is important to understand the characteristics of those bonds. One important bond characteristic is duration.

Duration is a measure of a bond’s sensitivity to changes in interest rates. Duration takes into consideration all cash flows of a bond’s principal and interest payments. All cash flows are discounted to their present value.

Using Duration

Duration is meaningful because it quantifies the change in a bond’s price for changes in its yield.

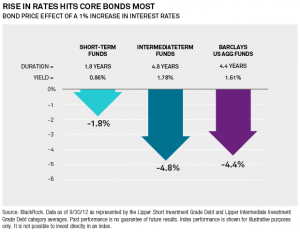

For a 1% change in interest rates, a bond’s price will change inversely by an amount roughly equal to its duration. We say “roughly,” because a 10-year bond has a duration of more than eight years, not 10 years, and a 12-year bond has a 10-year duration.

For example, a Duke Energy corporate bond with a 3% interest payment due on June 15, 2025 has a duration of 10 years. If interest rates rise by 1%, the bond will decline in price by about 10%. Conversely, if rates decline by 1%, the price of the bond will appreciate by 10%.

A corporate bond with a five-year duration will either appreciate or decline by 5% if interest rates increase or decrease by 1%, and a bond with a three-year duration will either appreciate or decline by 3% if interest rates increase or decrease by 1%. These are simplified examples and estimates, not real-world examples.

The shorter the duration of the bond, the less sensitive it is to changes in interest rates. In addition, the larger a bond’s coupon, the shorter the duration, because a greater proportion of the cash payments are received earlier.

Selling your longest duration bonds will help protect principal in a rising rate environment. By shortening the duration of your bond portfolio, you will have an opportunity to reinvest bond proceeds at higher interest rates as bonds mature.