It’s worth keeping the efficient market hypothesis in mind when considering the impact of Fed Chairman Ben Bernanke’s announcement this week that bond buying will be coming to an end.

The efficient market hypothesis suggests that share prices always incorporate and reflect all relevant information. While the hypothesis may be flawed, it should be no surprise that markets react to information, and that the announcement itself would have an impact, even though no one knows for certain when quantitative easing (QE) will end or when “tapering” or bond purchases will begin.

The price of a security at any given time reflects not only the performance of a company in the context of overall market conditions, but future expectations. So markets panicked because the Fed chief acknowledged the obvious – that QE will be ending someday.

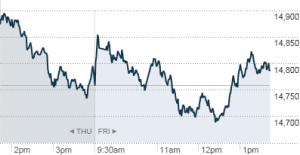

Other than admitting the obvious, The Fed’s comments were inconclusive, with plenty of “ifs,” “ands” and “buts,” and the market performance has been similarly inconclusive, jumping up and down enough to make investors seasick.

That queasy feeling is caused by volatility, which we discussed last week.

Can 54 Economists All Be Wrong?

Based on Fed comments, Bloomberg interviewed 54 economists for their opinions about what’s happening when. The consensus is that monthly bond purchases will drop from $85 billion to $65 billion in September and QE will end completely in June 2014. Nearly half of the economists – 44% — predicted that tapering would begin in September, compared with 27% in a survey taken at the beginning of June.

Of course, prognosticators are frequently wrong. The economy continues to be as volatile as the market has become and the political climate may also be a factor, especially as Mr. Bernanke’s term comes to an end. There also appears to be growing disagreement among board members about when to end QE and when to taper off bond buying.

Stock vs. Flow

One aspect of the QE tapering debate that has attracted some attention is stock vs. flow.

The Fed contends that it’s the “stock,” the amount of bonds held by the Fed, and not the “flow,” the amount the Fed continues to purchase, that’s important to the QE program. The markets, though, seem to have concluded otherwise.

If “stock” were all that counts, The Fed could likely draw a quick halt to QE tomorrow with no impact. The Fed’s portfolio now includes more than 30% of all U.S. bonds and is approaching $4 trillion. How much more is needed?

Maybe The Fed is looking at its portfolio as if it were an endowment fund, in which case bigger is always better.

At Least We’re Not Europe

While The Fed comments created chaos for U.S. markets, they had an even greater impact on the rest of the world. As one example, European equity markets closed down for the fifth week in a row for the first time since the summer of 2011, when the sovereign debt crisis was big news.

The Bloomberg Europe index was down 3.75% for the week, it’s biggest drop in 13 months, leaving the index unchanged for the year.