It seems that every day we hear about a stronger economy with real jobs, a recovered housing market and renewed manufacturing strength being just ahead.

We hear about it. We just don’t see it.

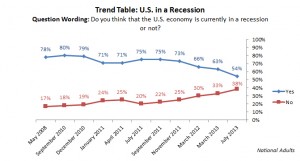

The economy’s been growing for four years now, yet its growth has been so stunted, most of the country still thinks we’re in a recession. The McClatchy-Marist Poll this week found that 54% of adult Americans think the U.S. in still in a recession, while only 38% think it’s not.

In an economy with a 7.6% unemployment rate (but really more than 14%), any sign of improvement is good news, so we can be thankful that the number of people who think we’re still in a recession is down from 63% in March and 75% in 2011.

Only 29% of those surveyed think their family finances will improve in the coming year, while 19% think they will worsen. More than half think they will remain the same.

Lee M. Miringoff, Director of The Marist College Institute for Public Opinion, treats the poll results as good news and notes that “President Obama plans to refocus his second term agenda on the economy.”

Well, that should save the day. Except that a separate poll finds that Americans have little faith in their political leaders.

Congress Breaks Record

A Wall Street Journal/NBC News poll this week found that President Obama’s job approval rating fell to 45%, its lowest level since late 2011. The President is still hugely popular, though – as long as he’s being compared with Congress, which has a record-high disapproval rate of 83%.

Just 29% of Americans surveyed say the country is “on the right track,” its lowest level in 11 months.

Just because Americans think we’re in a recession, it doesn’t mean we’re in a recession. And just because they disapprove of Congress and the President doesn’t mean that long-promised full-blown economic recovery, complete with real jobs, a recovered housing market and renewed manufacturing strength isn’t just ahead.

But consumer sentiment is reflected in consumer spending, and if consumers don’t spend, the economy isn’t recovering.

Delinquencies Are Up

And there’s plenty of other data that shows just how fragile the recovery is.

Lender Processing Services reported this week that, after five consecutive months of improvement, mortgage delinquencies rose 10% in June to a national rate of 6.7%.

And as we wait for that government solution to come along and fix the economy, consider how well the government solution to the foreclosure crisis is working. According to CNBC, “nearly half of the loans modified in 2009 under the Obama administration’s housing rescue program defaulted again.”

So the national average for delinquencies is 6.7%. The default rate for the Home Affordable Modification Program is about seven times higher.

We previously pointed out that the housing market recovery is an illusion and that mass purchases of housing by institutional investors has been boosting prices.

Now, though, the institutional investors have priced themselves out of the market. Purchases by institutional investors have boosted housing prices to the point where they are no longer attractive, so the institutional investors have stopped buying.

So the weakest recovery in history continues, staggering along like the “recovering” alcoholic who attends AA meetings, but keeps bottles of booze hidden at home.

The majority of Americans think we’re still in a recession. We’re not, but we may as well be.