At least it sounds like good news.

The U.S. Bureau of Economic Analysis announced that the economy grew at a rate of 2.84% during the third quarter. That’s up significantly from recent growth, which has been below 2%.

But if you find a silver lining in today’s economy, it’s sure to be surrounded by a black cloud. There are a few black clouds in this report:

- Preliminary numbers are almost always wrong. Funny how sometimes they’re overly optimistic.

- In spite of the higher growth rate, consumer spending is at its lowest level since the second quarter of 2011. In a healthy economy, consumer spending usually drives growth.

- Fixed investment, an indication of capital spending, dropped from 0.96% in the previous quarter to just 0.63%.

- Inventory doubled from 0.41% the previous quarter to 0.83% of the 2.8%. An increase in inventory is an underwhelming sign of economic growth.

Interestingly, government grew 0.04%, in spite of sequestration cuts. The numbers predate the 16-day government shutdown.

In addition, the growth number is bad news for those who expect quantitative easing to goose the market higher and higher forever. It means there’s less reason for QE moving forward – although, its only reason for existing today seems to be that no one knows how to stop it without wrecking the economy.

Toward that end, former Fed Chief Alan Greenspan said that Janet Yellen, who has been nominated to become the next Fed Chairman, will find tapering of Fed asset purchases without causing economic turmoil to be a challenge, noting that she “is going to have a very tough set of problems, and I think she knows it.”

Note, too, that even if you accept the latest growth figure as fact, 2.84% growth is still well below the 3.3% average growth rate the U.S. economy has enjoyed since World War II ended. And it’s taken five years of QE and stimulus spending to reach this point.

And Then There’s Europe

Just as the latest growth figures give the illusion that the U.S. economy is showing strong signs of rebounding, Europe’s touted recovery is similarly deceptive.

You may recall that the date by which Europe’s most economically troubled countries – Spain, Italy, Portugal, Ireland and Greece – were required to bring their deficits under control was postponed to give these countries more time to reduce their deficits. But did they? Of course not, except for Greece. You know you’re in trouble when your fiscal behavior makes Greece look like a role model.

Now, with interest rates rising, public debt ratios are increasing rapidly (see chart).

As a result, these countries will need to return to restrictive fiscal policies in 2014.

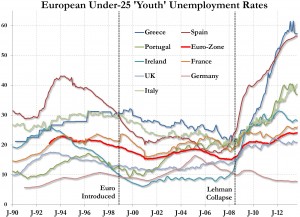

There are also concerns that a strengthening euro will offset gains in competitiveness that have taken place in recent years. In addition, with a rapid decline in inflation, a large differential between real interest rates and growth rates is a sign that deflation is a potential problem. And, of course, unemployment remains high, especially for young people (see chart).

Europe continues to play the important role of making the United States appear fiscally responsible.

Europe continues to play the important role of making the United States appear fiscally responsible.