Remember when the announced goal of quantitative easing (QE) was to reduce the unemployment rate to 6.5%?

It’s now 6.6% and heading down. So can we expect QE to finally end?

Not really. While new Fed Czar Janet Yellen talks about continuing tapering, many believe that tapering will stop and some believe she may reverse direction and increase the rate of bond buying. Even if The Fed continues to cut back bond purchases by $10 billion a month, it will still take more than six months for QE to end. Minutes of the Federal Open Market Committee’s January meeting, which were released this week, suggest that the final taper would take place in October 2014.

More specifically, the minutes say, “Several participants argued that, in the absence of appreciable change in the economic outlook, there should be a clear presumption in favor of continuing to reduce the pace of purchases by a total of $10 billion at each FOMC meeting. That said, a number of participants noted that if the economy deviated substantially from its expected path, the Committee should be prepared to respond with an appropriate adjustment to the trajectory of its purchases.”

Tapering aside, does anyone really think the unemployment rate is really decreasing?

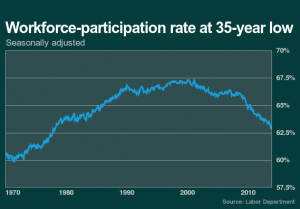

The workforce participation rate was at 63% in January, which is only marginally better than the 62.8% rate it was at when 2013 ended. What stands out, though, is that it has been below 64% for more than two years now and has been on a downward trend since 2008. That’s why this is called a “jobless recovery,” although if you’re among the jobless you may not notice any difference between this recovery and a recession.

As we’ve previously noted, the widely used U-3 unemployment rate excludes people who give up and stop looking for work and it includes as fully employed those who take part-time work, because they can’t find full-time jobs and are desperate for employment.

So if The Fed were to take an honest look at employment it would note that there’s still a great deal of work to be done. And if it were to take a really honest look, it would note that five years of QE have not helped create jobs.

We can only wonder what the unemployment rate would be if there hadn’t been five years of QE.