Finally, the U.S. Treasury Department has figured out a way to reduce the federal debt – by giving money away.

That may not make sense, but keep in mind that we’re talking about the federal government. And that means that money isn’t just given away; there are strings attached, unless you’re a preferred government contractor or an expert in Medicare fraud.

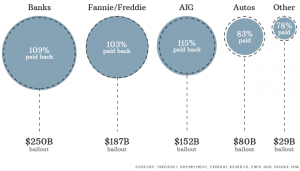

So consider this shocker. Fannie Mae is scheduled to make a $7.2 billion payment to the U.S. Treasury next month and, when it does, the total payments from Fan and Fred will add up to $192.5 billion, exceeding the $187.5 billion they received from taxpayers.

Granted, a 3% profit over five years isn’t really a profit, but we’re talking about the “toxic twins” here. And their payments are scheduled to continue, much to the chagrin of Fan and Fred shareholders. They can just get in line, though.

That’s not the only government bailout that’s been profitable – the Troubled Asset Relief Program (TARP) required a $250 billion investment for troubled banks, but brought in more than $272 billion, a profit of about 9%. AIG’s bailout was even more lucrative, bringing in $22 billion on an investment of $152 billion, for a 15% return.

Bailouts of General Motors and Chrysler haven’t been profitable, but what would you expect? Who’s going to buy a car from GM or Chrysler anyway? At least the auto companies paid back 83% of the $80 billion bailout before the government sold its stock and cut its losses.

As a whole, the U.S. Treasury contributed $421.6 billion toward bailouts and received back more than $432 billion. That’s a far better return that the government received from its investment in Solyndra, which didn’t even need a bailout when it received government funding. And what about the more than $800 billion in “economic stimulus” that was appropriated in 2009? Any return on that?

True, the bailouts have not been perfect. You could argue that Fan and Fred played a major role in causing the financial crisis, and that the $192.5 billion it’s paying out is chump change in comparison to the damage they caused the U.S. economy. You could argue that the AIG profit fails to consider as much as $17.7 billion in tax breaks the company received. And you could argue that the government auto bailout was designed to save the United Auto Workers union, not the car companies.

These are all valid points, but can you think of any other government program that has made money, rather than lost money?

More Bailouts Needed

So maybe it’s time to turn the bailouts up a notch. When you’re more than $17 trillion in debt and have nearly $100 trillion in unfunded liabilities, a few billion dollars in profits isn’t enough.

For starters, let’s bail out Europe. The International Monetary Fund (IMF), the European Central Bank (ECB) and the European Commission (EC), known collectively as the Troika, have been sinking billions into deadbeats like Greece and Italy, and the only thing they have to show for their handouts has been demands for more money.

Europe needs trillions, so even a small profit should produce hundreds of billions for the U.S, Treasury. It should be enough to make a nice dent in the federal debt, although, let’s be honest – European countries are about as likely to pay off their debt to the U.S. government as the U.S. government is to use the payments to pay down its debt.

Another good candidate for a bailout would be America’s gamblers, who rack up an estimated $72.2 billion in losses a year. Based on other bailouts, lending to America’s gamblers may bring in only a few billion dollars a year in profit, but it would prevent many broken legs and would put more than a few loan sharks out of business. It’s also in keeping with the bank bailouts, and Fan and Fred bailouts, which rewarded people for taking too much risk. The difference is that America’s gamblers are risking their own money, not ours.

Maybe the best candidate for a government bailout is the government itself. Financially, it’s in worse shape than GM and its future prospects are glum. Plus, the need is so great, even a small profit would produce hundreds of billions of dollars in new revenue.

The money could be used to reduce taxes, but let’s be realistic. The most we can expect is that it will produce enough revenue to keep taxes from rising too quickly.