“Democracy would not be democracy, rule of the people, without at least a modicum of political attention and activity from its citizens.” James Bovard, Attention Deficit Democracy

Is anyone paying attention?

It seems as though the faster the world moves, the shorter our attention span becomes. And today, speed is measured in nanoseconds.

Many have become complacent as technology has taken over. High frequency trading, in which computers make the decisions, accounts for the majority of trades today. HFT is based on arbitrage. Computers look for discrepancies in pricing and take advantage of them, and that’s how money is made. A company’s performance is irrelevant.

Humans created computers, but can’t compete with them. They can try to produce a better algorithm, but the computers will make the decisions.

Technology has affected much more than just trading, of course. Consider communications. The telephone made it possible to communicate almost instantly. The Internet, though, has made communications even faster. Anyone with a computer can send a message to a database of thousands with the click of a mouse. We can not only hear, but see people anywhere in the world while we talk to them, and our smartphones guarantee that we remain virtually connected at all times.

These and other technological developments have been a big boost to productivity, but they remove the human element. Life in real time is also life on auto pilot. We’re connected electronically, but disconnected socially and emotionally.

Think Beyond the Next Quarter

The book “Attention Deficit Democracy” details how Americans have become complacent and disengaged from politics, resulting in the erosion of democracy. The same is true, unfortunately, of our economic system.

The result is attention deficit capitalism. The stock market has been trending upward for five years in spite of the weak economy and the Federal Reserve Board is now worried that investors have become too complacent and unafraid of risky investments. The Volatility S&P 500 (VIX), a measure of expected stock-market fluctuations based on options trading, has gone 74 straight weeks below its long-run average. The last time the VIX was so low for so long with in 2006 and 2007, the period leading up to the financial crisis.

CEOs and other managers also have a short attention span. While investment managers advise their clients to “think long term,” it’s a rare public company that thinks beyond the next quarter’s financial results.

Living for Today

Consumers, likewise, often spend more time planning their vacations than they do planning for their retirement. When that happens, they retire without enough money to live on.

We save to send our children to college, so they can get good jobs and support themselves, yet in today’s world a college education doesn’t always provide a great return on investment.

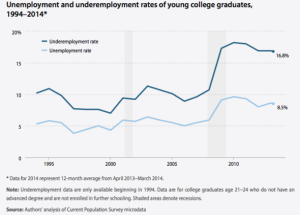

College students graduate with an average of $29,400 in debt, according to 2012 figures, up from $18,750 in 2004. Total student debt exceeds $1 trillion. At the same time, the Economic Policy Institute reports that the unemployment rate for college graduates this year is 8.5%. However, the EPI also reports that 16.8% of college grads are underemployed.

Worse still, the Federal Reserve Bank of New York found that about 44% of college graduates aged 22 to 27 are in jobs that do not require them to have a bachelor’s degree.

Adults also have more debt than they can handle. While household debt was trending down in recent years, it’s been increasing again for the past three quarters, according to Reuters, and is now up to $11.65 trillion, an increase of $129 billion for the most recent quarter.

Does it matter if we have attention deficit capitalism? It matters because fewer and fewer investors remember the bubble that burst in 2000, when stock prices seemed to be going only one way – up. It matters because fewer and fewer investors remember the bubble that burst in 2007, when housing prices seemed to be going only one way – up.

If we remain complacent, if businesses remain complacent and if our elected officials remain complacent, attention deficit capitalism will only worsen. Free markets will become less free, our standard of living will continue to deteriorate and the next generation will not have a better life than our generation.

We need to not only think long-term, but act long-term.