Easy money policy has its share of side effects. The stock market continues to hit new highs, thanks to the Fed, but the level of risk that investors and taxpayers are exposed to also may be close to new highs.

The market for U.S. Treasuries, as one example, is a “risk on” market. As Bloomberg put it, “Just because U.S. Treasuries look more and more stable doesn’t mean they are.”

Some may mistake a lack of volatility for low risk, but the lack of volatility appears to be the result of less liquidity, not lower risk, as the Fed has purchased trillions of dollars in bonds and banks are pulling back from debt trading.

Before the financial crisis, lower volatility resulted in more trading, but in this case trading volume has dropped.

“What’s happening instead,” Bloomberg reported, “is unprecedented central-bank stimulus has sent everyone into the same risk-on bets, while it’s also becoming more difficult to trade as banks shore up their balance sheets in the face of new regulations.”

Bloomberg then quotes Citigroup strategist Matt King as saying, “We blame the wave of central-bank liquidity, which has pushed up asset prices irrespective of fundamentals. “This creates a vicious circle: ever-higher prices, ever-less trading and (ever-less) liquidity.”

The Fed this week announced that it would continue to reduce its bond purchases, which will drop from $45 billion to $35 billion a month, but there is some concern about the impact that weaning the Fed off of its bond-buying addiction will have on the market.

“The concern,” Bloomberg wrote, “is that the lack of trading on the way up in the market is a harbinger of poor liquidity on the way down – or more volatility as investors head in the opposite direction. In other words, that could mean more pain for investors.”

“The markets’ mojo is gone,” King concluded, “and we’re not sure it’s coming back.”

The Bond Run Conspiracy

There was also an announcement this week that the Fed is preparing to impose exit-fee gates on bond funds to prevent a run by exiting investors as interest rates increase. But there’s some concern that doing so would have the opposite effect.

Zerohedge noted, “it goes without saying that ‘discouraging investors’ from withdrawing funds is the last thing on the Fed’s mind, which knows very well that when it comes to investor behavior all that matters is how the Fed’s future intentions are discounted. And with this unprecedented step, the Fed is sending a very clear message: it may be next year, or next month, or next week, but quite soon you, dear retail bond-fund investor, will be gated and will be unable to pull your money … what is the obvious desired outcome, at least by the Fed? Why a wholesale panic withdrawal from bond funds now, while the gates are still open, and since those trillions in bond funds have to be allocated somewhere, where will they go but … stock funds.”

While we should all be wary of conspiracy theories, a Fed publication titled, “Gates, Fees, and Preemptive Run” notes that “there can be preemptive runs that occur only because an intermediary has the ability to impose ‘standby’ (liquidity-contingent) gates or fees.”

So if the Fed were to impose exit fees, it would be doing so knowing that a bond run would likely result.

But Fed Chair Janet Yellen said this week that it’s not the Fed that’s considering fees, but the Securities and Exchange Commission. So conspiracy theorists can relax – it’s the SEC that’s trying to cause a run on the bond market, not the Fed. Maybe the SEC is sick of the Fed getting all of the credit for pumping up stock prices.

The Complacent Investor Conspiracy

Just as the Fed may be starting a bond run to avoid a bond run, it may also be reinforcing investor complacency to prevent investor complacency.

Noting that the VIX (volatility index) was approaching single digits, Zerohedge reported that “as a result of her droning monotone,” Fed chief Janet Yellen “managed to put the VIX literally to sleep,” as it closed at its lowest since 2007.

The S&P 500 reached yet another record high this week, because “despite the ‘concerns’ Fed members have about record high complacency, all they are doing is adding to it.”

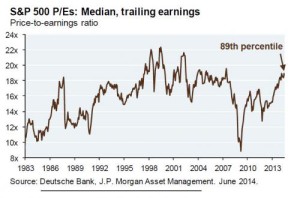

With the price-to-earnings ratios of S&P 500 stocks higher than they have been over 89% of the history of the index, it’s not a good time to be too complacent.