It’s all stress-free bliss these days … at least for anyone who’s not paying attention.

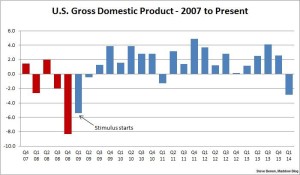

Has someone been putting anti-depressants in the water supply? That’s one way to explain Wednesday’s non-reaction to the report that the economy shrank by 2.9% in the first quarter – not the 1% drop previously reported.

It would also explain continued investor complacency reported last week, with the VIX (volatility index) approaching single digits. And it would explain the plunge in junk bond yields to 5.6%, which is a full 3.4% points lower than the decade-long average of 9%.

Yet investors showed that they still have a pulse, when they took the Dow down 100 points after James Bullard, president of the St. Louis Federal Reserve, announced that an interest rate hike may take place in the first quarter of 2015.

Yet investors showed that they still have a pulse, when they took the Dow down 100 points after James Bullard, president of the St. Louis Federal Reserve, announced that an interest rate hike may take place in the first quarter of 2015.

So consider this in context. In addition to the slumping economy, we have Russia’s continued takeover of Ukraine, which is now being overshadowed by the continued takeover of Iraq by Muslim terrorists known as ISIS and the possibility of U.S. military intervention. We have civil war continuing in Syria and continued nuclear development in Iran, in spite of the lifting of sanctions. We have U.S. veterans in need of medical treatment being ignored while the Veterans Administration fudges numbers. We have the missing e-mails of Lois Lerner and six other IRS employees who allegedly targeted conservative groups. We have continuing fallout in the healthcare industry from the pains of implementing Obamacare. We have a stock market so overblown that price-to-earnings ratios are at levels higher than they’ve been through 89% of the history of the S&P 500.

So what’s moving the market? A statement made by a Fed board member that repeats a statement he previously made.

“While the comments about a rate hike match Bullard’s previous forecast, they appeared to take the market off guard because the Fed official is normally very dovish,” according to CNN.

Oh, that explains it. We can’t live in the Fed’s Never Never Land forever. Someday, near-zero interest rates will grow old.

When Interest Rates Rise

Remarkably, the stock market has continued to hit new records even while the Fed has been tapering its bond buying, but one reason the market has not been affected more is that the Fed has emphasized that there is no relationship between reducing bond buying and raising interest rates.

In other words, the Fed has been saying or hinting that interest rates will remain low.

Even the hint of a rise, though, has an impact. So what will happen when they really do rise?

The stock market will likely return to more realistic levels. It would be healthy, long-term, for prices to reflect fundamentals again, but investors who are heavily invested in stocks will, of course, take some losses.

Separately, though, a rise in interest rates would affect credit markets.

“Now, as the Federal Reserve discusses ending its easy-money policies, concern is mounting that the withdrawal of stimulus will lead to an exodus that’ll cause credit markets to freeze up,” according to Bloomberg. “While new regulations have forced banks to reduce their balance-sheet risk, analysts at JPMorgan Chase & Co. are focusing on the problems that individual investors could cause by yanking money from funds.

“There’s a bigger risk ‘that when the Fed starts hiking in earnest, outflows from high-yielding and less-liquid debt will lead to a free fall in prices,’ JPMorgan strategists led by Jan Loeys wrote in a June 20 report. ‘In extremis, this could force a closing of the primary market and have serious economic impact.’ ”

In extremis, indeed.

The Fed’s quantitative easing stimulus program has been unprecedented. As such, ending such a program is unprecedented. We will find out what happens when it happens.