“This is what it sounds like when doves cry.”

Prince

Imagine this. After more than five years of mediocre economic growth and a quarter of “negative growth,” the economy grew at a rate of 4.0% in the second quarter.

At least that’s what the Bureau of Economic Analysis (BEA) said. The BEA previously estimated that the economy shrank by 2.9% during the first quarter, but has readjusted its analysis and now says that the economy shrank by 2.1% in the first quarter.

From 2.9% “negative growth” to 4.0% positive growth is a swing of nearly 7% in a span of just three months.

That’s quite a swing … but do you believe it? After all, Q1 growth was reported at -1%, -2.9% and finally -2.1%, so how much confidence should we have in the BEA’s first report for Q2?

Meteorologists are often criticized for erring on the weather, but they’re forecasting. The BEA is trying to tell us what happened more than a month ago – and still can’t get it right.

Hoarding and Unhoarding

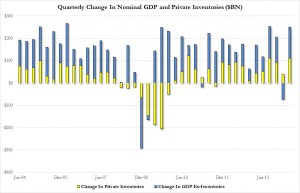

Regardless of BEA inaccurate, another reason for the volatile GDP numbers is that inventory hoarding is causing quarter-to-quarter distortions.

As Zerohedge reported, “Back in December 2013, when everyone was expecting a 3% GDP print for Q1, we did a simple analysis concluding that ‘Inventory Hoarding Accounts For Nearly 60% Of GDP Increase In Past Year.’ We stated that this ‘hollow growth,’ which is merely producers pulling demand from the future courtesy of cheap credit and assuming the inventory will be sold off in ordinary course of business without bottom-line slamming liquidations or dumping, and which further assumes a healthy US consumer and global economy, is a flashing red flag for the future of US economic growth.”

When the economy grows because inventory is growing, the impact is short-term, because at some point hoarded inventory has to be unhoarded and sold.

According to Zerohedge, hoarding was a major contributor to Q4 13 growth and to Q2 14 growth, while unhoarding was a major contributor to Q1 14’s shrinking economy – and it is likely to be a major contributor to the Q3 14 economic report. If Zerohedge is correct, the economic recovery that everyone seems to be talking about may be yet another mirage.

Live by the Fed, Die by the Fed

So, given this wondrous economic growth, the stock market should be soaring. So how did stocks perform this week?

Thursday, the Dow Jones Industrial Average plunged more than 300 points, eliminating all of its gains for the year, while the Standard & Poor’s 500-stock index had its largest decline since April. The Russell 2000 fell 5.3%, making July its worst month in more than two years.

There were plenty of reasons for the decline – including disappointing earnings reports, Argentina’s default on its debt, and conflicts in Ukraine and Gaza. Another reason, to be sure, is, as The New York Times reported, “relatively strong economic reports in the United States this week may have caused concern among traders that the Federal Reserve might tighten its expansive monetary policy.”

The Fed’s bond-buying program boosted the stock market to record highs by making other investments less attractive. But the great taper is supposed to end in October. Already, the Fed has reduced bond buying from $85 billion a month to $35 billion, with another $10 billion scheduled to be loped off in August.

If buying bonds caused the market to soar, it’s no surprise that when the buying stops, the market will retreat.

The Fed has prevented investors from reacting too dramatically to tapering by announcing that, even as quantitative easing ends, interest rates will remain low.

But given the announced economic growth, the Federal Open Market Committee (FOMC) saw its first hawkish dissent under Chair Janet Yellen this week, when Philadelphia Fed President Charles Plosser objected to the Federal Open Market Committee’s statement that it would keep interest rates low for “a considerable time” even after QE ends.

In other words, live by the Fed, die by the Fed.

Wall Street may be hoping that Zerohedge is right and that inventory unhoarding will again stunt economic growth. If that happens, the Fed will likely keep interest rates near zero and the stock market can continue setting records.