“Credit is a sacred trust, it’s what our free society is founded on. Do you think they give a damn about their bills in Russia?” Bud in “Repo Man”

The good news for the economy is that consumers are buying more. The bad news is that they’re not paying for what they buy.

The Urban Institute found that more than a third of Americans are not only in debt, but are being chased down by debt collectors. Debt collectors are, of course, a last resort; they’re used when all else fails and the debtor is more than 180 days past due. When a consumer goes six months without paying a bill, it’s a good sign the person either has no intention of paying or is unable to pay.

Yet about 77 million Americans – 35% of adults with a credit file – have debt in collections. They owe an average of $5,178, which doesn’t sound like much, but keep in mind that’s debt that’s gone into collection, not total household debt. It does not include mortgage debt, but does include credit card, medical and utility debt.

The average American household has $15,480 in credit card debt alone and consumer debt totals $11.74 trillion. Add in federal debt, corporate debt, state government debt, municipal debt and the debt of other countries and it’s a wonder that anyone anywhere is still solvent.

The average American household has $15,480 in credit card debt alone and consumer debt totals $11.74 trillion. Add in federal debt, corporate debt, state government debt, municipal debt and the debt of other countries and it’s a wonder that anyone anywhere is still solvent.

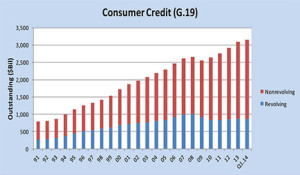

You may recall the cheering that took place in 2009, when consumer debt levels decreased. But, as the chart shows, that was a small mogul on a steep and steadily rising mountain of IOUs.

The increase in debt collection shouldn’t be surprising, given that more than 100 million Americans are not working and that median household income has dropped nearly 10% since the financial crisis began, but it’s one of the nasty side effects of the dismal economic growth the U.S. has experienced for more than five years.

If consumer spending produces economic growth and if consumers have no money to spend and have tapped out their credit cards to the point where collection agencies are being brought in, it’s not a good sign of things to come.

Driving Economic Stagnation

Another not-so-good sign is that the rate of car repossessions jumped 70.2% in the second quarter, with much of that increase coming from finance companies not run by automakers, banks or credit unions.

As NBC put it, “The repo man is getting very busy as a growing number of car and truck owners are struggling to make their monthly auto loan payments.”

And Zerohedge noted, “we have been closely following the ongoing deterioration of the car subprime loan bubble: something that both Bloomberg and the Fed have also been paying close attention to recently, yet a bubble which nobody wants to burst, because, as we wrote several days ago, it is none other than the subprime car loan bubble that allowed car production to surge the most last month since Obama’s Cash for Clunkers capital misallocation program, in the process lifting overall manufacturing and Industrial Production, and thus GDP.”

In fact, auto loans hit an all-time high of $839 billion, climbing 11.7% in the second quarter, according to Experian.

Not to worry, though. As Melinda Zabritski, senior director of automotive finance for Experian Automotive, noted, the surge in delinquencies and repossessions is being driven primarily by borrowers with subprime and deep subprime credit scores.

In other words, a major American industry is selling its products to people who can’t afford them and are unlikely to pay for them.

Anyone who wonders where that will lead has a very short memory.